Gold prices have fallen below $2,985 per ounce, continuing a three-day downward trend as investors liquidate positions amid broader market volatility and concerns over new tariff policies.

Gold (XAU) Falls Below $2,985 Amid Market Turbulence

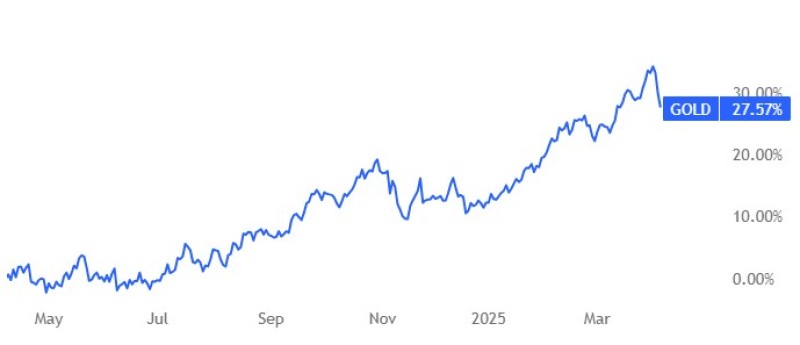

Gold prices have retreated below the $2,985 per ounce mark, marking the third consecutive session of losses. This decline comes as investors are forced to sell their holdings to cover margin calls and take profits in the midst of widespread market volatility. The precious metal, typically considered a safe haven during times of uncertainty, has paradoxically faced selling pressure as investors seek liquidity to address losses in other asset classes.

The downward movement in gold prices has been playing out against a backdrop of broader market turbulence, with equities and other commodities experiencing significant price swings. Despite gold's traditional role as a hedge against economic and political uncertainty, the current market dynamics have temporarily overshadowed this function.

Gold (XAU) Reacts to Trump's Tariff Policy Announcements

The selling pressure on gold (XAU) intensified following a series of headlines related to President Trump's trade and tariff policies. These announcements have rattled investor sentiment across various markets, including precious metals. While gold typically benefits from geopolitical tensions, the immediate need for liquidity appears to be the dominant factor driving current price action.

Administration officials have made efforts to calm market concerns, insisting that the proposed tariffs will not derail economic growth. However, many market analysts remain skeptical, warning that these trade policies could potentially lead to slower economic growth and rising inflation – a combination that could eventually support gold prices in the longer term, despite the current selling pressure.

Gold (XAU) Market Experiences Volatility as Trump Threatens Additional Tariffs

Adding further complexity to the gold (XAU) market outlook, President Trump has threatened to impose a 50% tariff on Chinese imports unless China removes its 34% retaliatory duties on American goods. This escalation in trade tensions between the world's two largest economies has contributed to the overall market uncertainty, creating a complex environment for gold price movements.

The precious metals market was also impacted by rumors regarding a possible 90-day pause in tariff implementation. These rumors briefly influenced trading patterns before the White House issued a denial, triggering sharp intraday swings in equities markets that subsequently affected gold prices. Such rapid shifts in market sentiment have created a challenging environment for gold traders attempting to navigate the current volatility.

Gold (XAU) Outlook Remains Complex Amid Economic Uncertainty

Despite the current selling pressure, gold's fundamental appeal as a store of value during times of economic uncertainty remains intact. The potential inflationary impact of tariffs, combined with concerns about slowing economic growth, could eventually provide support for gold prices once the immediate liquidity-driven selling subsides.

Market participants are closely monitoring economic indicators and central bank responses to the evolving trade situation. If inflation concerns materialize while economic growth slows, this could create a stagflationary environment that traditionally benefits gold prices in the medium to long term.

Gold's current price decline represents a complex interplay of immediate market liquidity needs and longer-term fundamental factors. While the short-term technical picture suggests continued pressure, the macroeconomic backdrop—characterized by trade tensions, potential inflation, and economic uncertainty—may eventually reassert gold's traditional role as a safe-haven asset and inflation hedge.

As markets continue to digest the implications of tariff policies and potential economic impacts, gold traders remain vigilant for signs of stabilization and potential buying opportunities at lower price levels. The precious metal's performance in the coming weeks will likely be influenced by further developments in trade negotiations, economic data releases, and shifts in overall market sentiment.

Peter Smith

Peter Smith

Peter Smith

Peter Smith