Gold (XAU) prices have reached new all-time highs, making it a compelling investment amidst economic uncertainties.

XAU Prices Reach Unprecedented Highs

The gold market has been on an extraordinary trajectory since the start of 2024, with XAU prices consistently breaking records and capturing investor attention. This trend began in March when gold prices surged to a new high of $2,160 per ounce, an 8% increase from the previous record set in December 2023. The bullish momentum continued into April, with XAU reaching another milestone of $2,259.29 per ounce on April 1. By late May, prices soared to $2,439.98 per ounce.

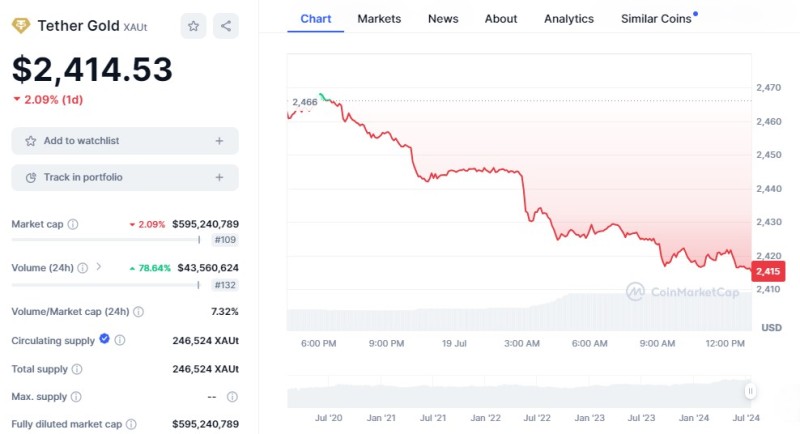

After a brief stabilization, gold (XAU) is once again making headlines. This week, the price of gold teetered on a new all-time high, and on July 19, it climbed to $2,414.53 per ounce, setting another record and reinforcing gold's status as a robust asset in the current economic landscape.

1. Potential for Further Price Appreciation in XAU

Even with gold prices reaching several record highs this year, some experts believe there is still room for growth. Central banks increasing their XAU reserves is one factor supporting this outlook. Unlike fiat currencies, which can be printed at will, the global gold supply is finite. As demand for this precious metal continues to grow, its limited supply could drive prices even higher.

The use of XAU in various industries, including electronics and healthcare, is also expanding. As new applications for gold are discovered and implemented, industrial demand could further boost prices. Thus, while the price is high now, there remains potential for future growth. By investing in XAU now, you may capitalize on any future price increases.

2. XAU as a Hedge Against Economic Uncertainty

Although inflationary pressures have been cooling recently, the global economy faces numerous challenges, including ongoing geopolitical tensions. Gold is a wise choice for investors, as it has long been regarded as a reliable hedge against economic uncertainty.

XAU tends to maintain its purchasing power over long periods due to its inherent value. While traditional currencies can lose value due to inflation or other economic issues, gold acts as a hedge against currency risk. As the value of a currency declines, the price of XAU typically rises, preserving wealth for investors holding gold.

During severe economic stress or geopolitical turmoil, gold often sees increased demand from investors seeking safe haven assets. This can lead to price appreciation when other assets may be declining in value. Additionally, XAU is highly liquid and can be easily converted to cash, providing investors with financial flexibility during uncertain economic times.

3. Diversification Benefits of XAU

Diversification is a cornerstone of sound investment strategy, and gold offers unique benefits that can enhance a portfolio's resilience and performance. XAU typically has a low or negative correlation with stocks and bonds. When traditional assets decline in value, gold often moves in the opposite direction or remains stable.

Including XAU in a diversified portfolio can reduce overall portfolio volatility, protecting against future losses if or when market volatility increases. This diversification makes gold a compelling option for investors looking to safeguard their investments.

Conclusion

As with any investment decision, it's essential to carefully consider your individual financial goals, risk tolerance, and overall investment strategy before buying in. However, for investors seeking stability, diversification, and potential growth in an increasingly uncertain world, XAU remains a compelling option, especially given its recent upward price trajectory and the likelihood of future growth.

Usman Salis

Usman Salis

Usman Salis

Usman Salis