Gold (XAU) is at a pivotal moment as momentum fades following its strong rally earlier this month. Trading around $4,340, XAU/USD is showing signs of hesitation near recent highs, suggesting a consolidation phase before the next significant move.

Key Technical Setup Shows Double-Top Risk

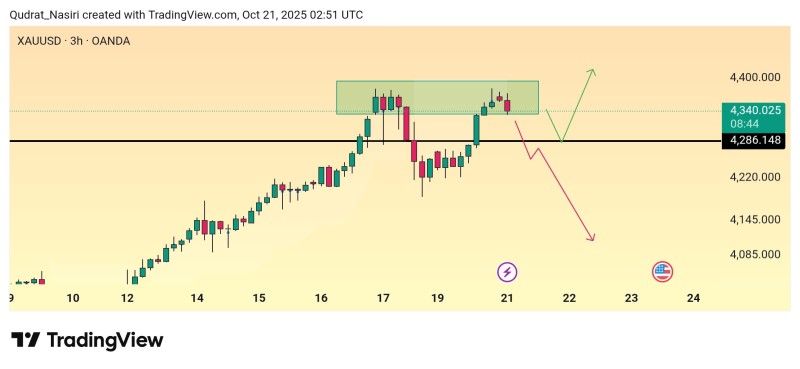

According to trader Giant Bull, who provided the latest chart analysis, gold may be forming a double-top pattern on shorter timeframes—a potential warning that bullish momentum is weakening. The critical support sits at $4,280, which could determine whether gold continues climbing or enters correction territory.

The 3-hour chart reveals gold's recent journey from below $4,150 into a consolidation band between $4,280 and $4,360, creating a rectangular resistance zone. This setup presents two distinct scenarios: if gold stays above $4,280, buyers might push prices toward $4,400 or beyond, confirming the uptrend's continuation. However, a clean break below $4,280 would validate the double-top formation, potentially triggering a pullback toward $4,145–$4,100. The chart's green and red arrows illustrate these competing breakout and breakdown possibilities, highlighting the current market indecision.

Macro Forces Behind Gold's Pause

Gold's sideways action mirrors broader uncertainty in global markets. Traders are navigating shifting Fed rate expectations, climbing energy prices, and ongoing geopolitical tensions—all contributing to commodity volatility. The recent rally was fueled by softer Treasury yields and a weaker dollar, boosting gold's safe-haven appeal. But as yields stabilize and risk appetite improves, gold has cooled off, leading to the current range-bound trading.

Still, the medium-term outlook remains constructive. Central banks keep adding gold to their reserves, and inflation stays above target levels in many regions, maintaining gold's role as an inflation hedge and portfolio diversifier.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah