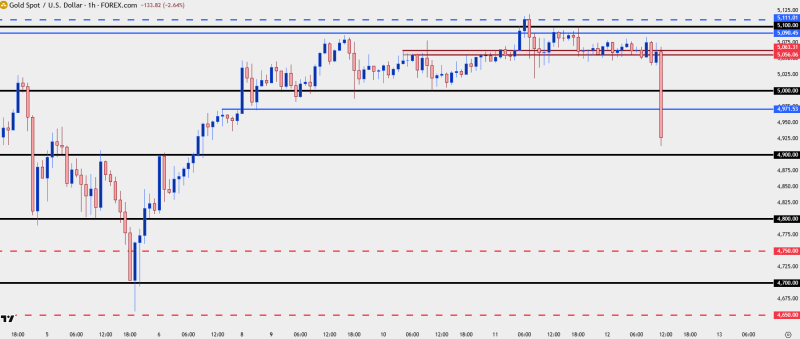

⬤ Gold prices slid lower after XAU couldn't hold the consolidation range below resistance near $5,100. Support around $5,000 eventually cracked following repeated rejections at higher levels, triggering a sharp drop on the chart. The breakdown as the psychological level gave way.

⬤ The price action shows a prolonged range beneath resistance before sellers shoved the market through the floor. The move signals a clean breakdown rather than slow erosion, with liquidation pressure picking up speed once the level snapped. Similar rejection patterns near resistance recently appeared when Gold stalls below 5057 resistance.

⬤ Traders now eye lower zones around $4,900, then $4,800 and $4,750—areas that previously sparked reactions. Market watchers also point to positioning shifts ahead of inflation data and thin liquidity during the U.S. holiday period as possible triggers for volatility. Comparable downside structures surfaced when Gold falls sharply toward key support levels and broader pullback setups in Gold price forecast faces downside risk after rejection.

⬤ The breakdown highlights how closely watched technical thresholds swing short-term sentiment when breached. Once a major support cracks, participants reposition around new price zones, pushing the market from range-bound conditions into directional moves.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah