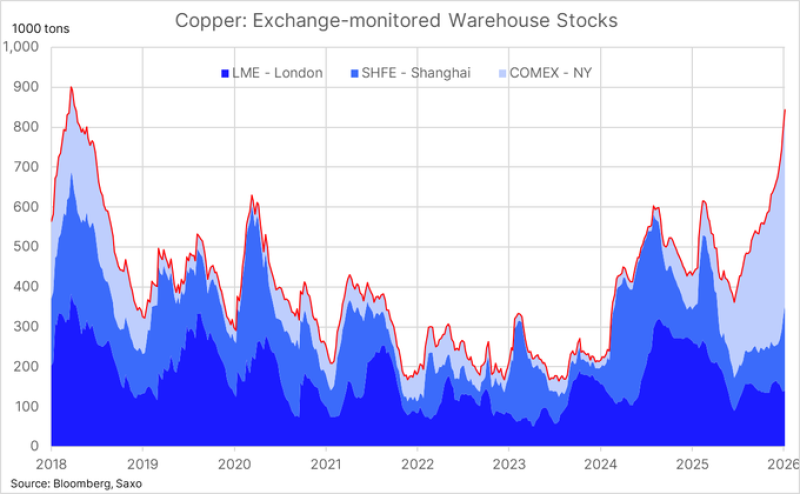

⬤ Copper prices are pulling back after hitting record highs earlier this week. Near-term fundamentals are struggling to justify the rally, with exchange-monitored stockpiles jumping by 54,000 tons this week to reach 843,300 tons—the highest level in almost eight years. This inventory surge suggests the market may be entering a consolidation phase.

⬤ Shanghai saw the biggest increase, with stockpiles rising 33,000 tons to 213,500 tons, marking a nine-month high. COMEX inventories continued climbing to a fresh record of 488,700 tons. These numbers indicate supply is catching up with demand, which could pressure prices in the near term.

⬤ The growing inventories across Shanghai and COMEX point to shifting market dynamics. While copper surged earlier this week, the stockpile buildup raises concerns about a potential supply glut. Without sustained demand growth, prices may face headwinds as the market adjusts.

⬤ The stockpile surge highlights a cooling trend in the copper market. As inventories across major exchanges continue expanding, the balance between supply and demand will be critical in shaping price movements over the coming months.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah