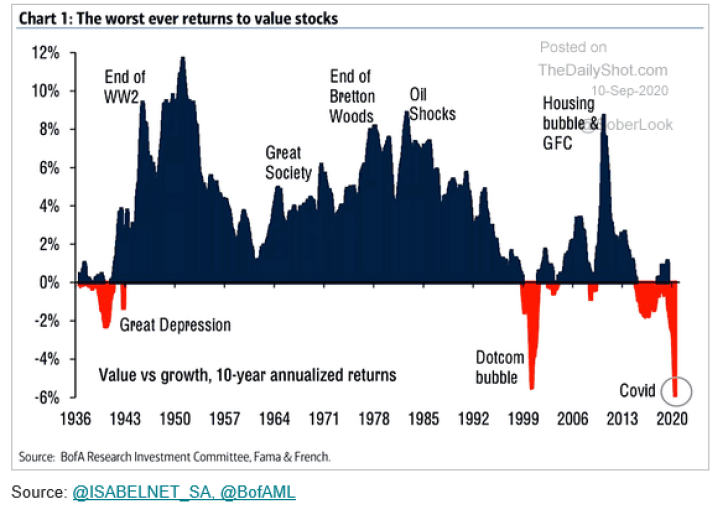

Value stock returns are worst than ever, even worse than they were during the Great Depression and the crisis in the 2000s, the growth bubble and the collapse of the Dotcom bubble, according to the chart, provided by Gregory Daco.

Value stocks are stocks that are currently trading below what they are really worth, and therefore should perform better in the future. Growth stocks, by contrast, are those that have the potential to outperform the market over time because of their future potential.

Peter Smith

Peter Smith

Peter Smith

Peter Smith