Passive Hedge Funds Are Suffering due to Volatility

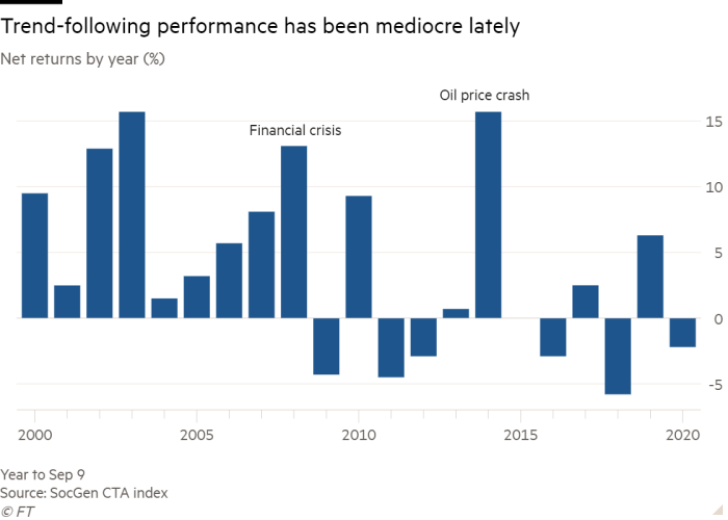

2020 has been a tough year for passive hedge funds. According to the Financial Times, trend-following hedge-funds struggled this year due to the increased volatility and global instability.

Passive funds copy the structure of a certain large index in the fund's portfolio. Often such funds show better results than funds with active management, especially in the years in which the market grew steadily without changing the trend for a long time.

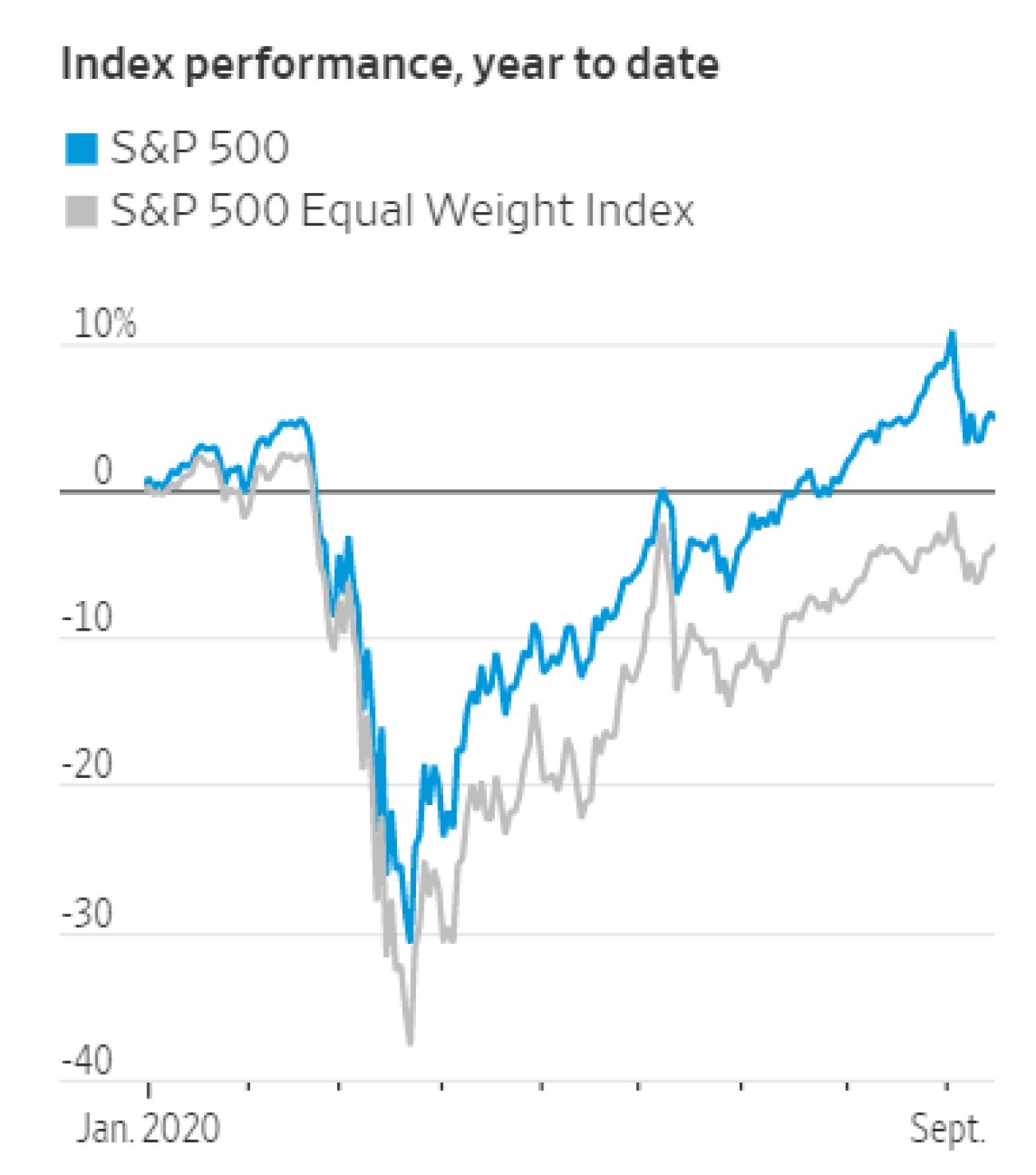

Most Companies Are still Undervalued Comparing with February Highs

However, during periods of volatility, active management is much better, as managers have the opportunity to invest in individual rising stocks.

Let us recall that at the moment only a relatively small number of shares managed to increase the price above the February highs, the vast majority of shares on the US market have not yet been able to rise to their winter price.

Peter Smith

Peter Smith

Peter Smith

Peter Smith