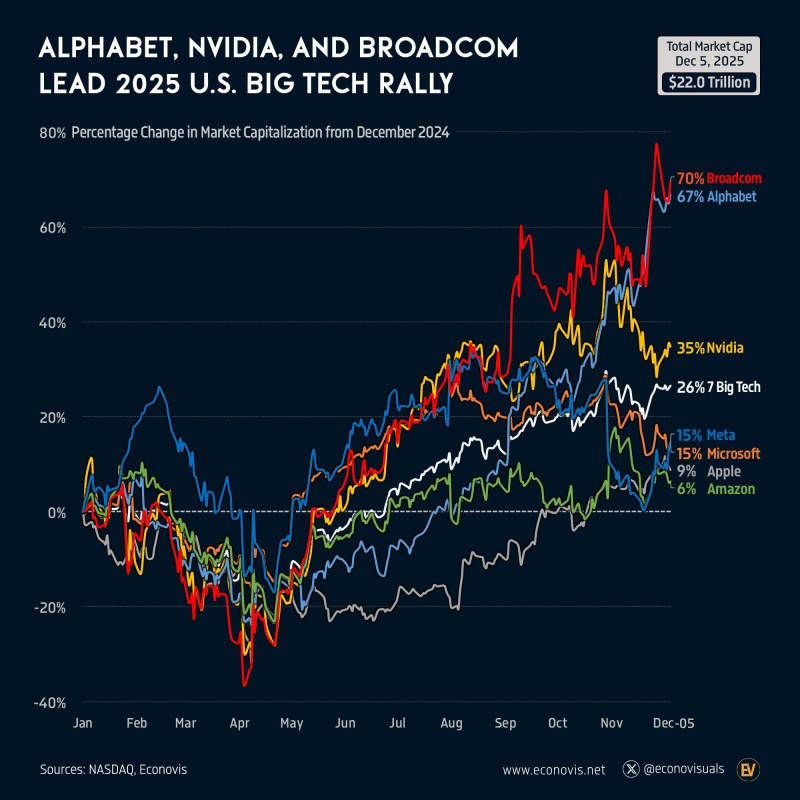

⬤ Big Tech delivered massive gains in 2025, and three companies stood out from the pack. The combined market cap of seven tech giants—Nvidia, Apple, Alphabet, Microsoft, Amazon, Broadcom, and Meta—reached $22 trillion by December 5. That's a 26.5% jump from last December, adding $4.2 trillion in value as AI demand continued surging across hardware, cloud platforms, and data infrastructure.

⬤ Alphabet, Nvidia, and Broadcom led the charge throughout the year. Alphabet climbed 67%, tacking on $1.56 trillion in market value. Nvidia gained 35%, expanding by roughly $1.14 trillion. Broadcom posted the strongest surge at 70%, adding $760 billion. Together, these three companies generated about 75% of the group's total market value increase, showing just how much AI-related business lines have shaped market momentum this year.

⬤ The other four members turned in solid but more modest results. Microsoft and Meta both advanced around 15%, Apple rose 9%, and Amazon gained 6%. While they lagged behind the AI leaders, each still contributed positively to the sector's overall performance. The gap between companies with heavy AI exposure and those with more diversified revenue streams was clear, but the entire sector trended upward.

⬤ This pattern matters because it shows how AI-focused companies are reshaping market leadership and valuation. The concentration of returns among Nvidia, Alphabet, and Broadcom reflects growing investor emphasis on AI infrastructure, semiconductor capabilities, and cloud-scale data processing. Since Big Tech represents a huge chunk of total market cap, how these companies perform plays a central role in driving sentiment, sector rotation, and expectations heading into 2026.

Usman Salis

Usman Salis

Usman Salis

Usman Salis