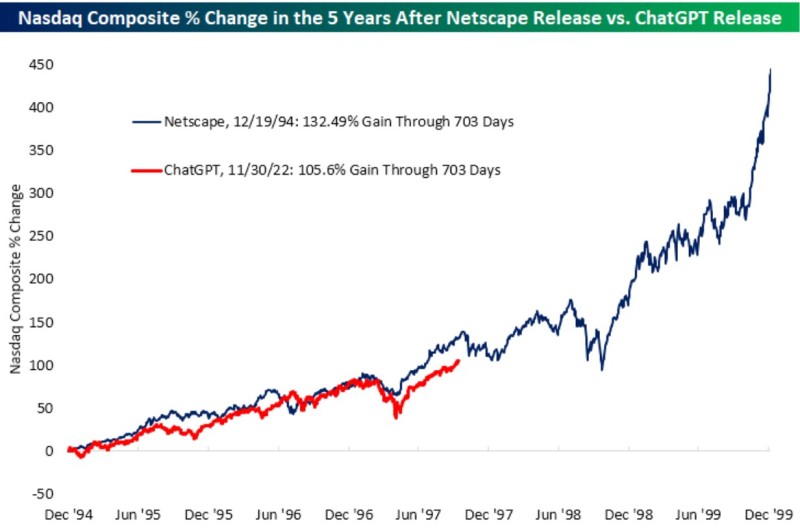

Financial markets have a way of echoing the past, even when the underlying technologies are vastly different. A compelling chart from Bespoke compares how the Nasdaq Composite performed in the first 703 days after two pivotal tech moments: Netscape's browser launch in December 1994 and ChatGPT's debut in November 2022. Both events triggered significant market rallies, but the patterns reveal important distinctions about today's AI-driven surge versus the internet boom of the 1990s.

Performance Comparison

- Netscape era (Dec 1994): Nasdaq jumped 132.49% over 703 days, driven by internet adoption and dot-com IPO fever

- ChatGPT era (Nov 2022): Nasdaq gained 105.6% in the same timeframe, fueled by AI excitement and semiconductor demand

Both periods show similar early growth trajectories with consolidation phases followed by renewed momentum. However, the Netscape era's curve turned parabolic in the late 1990s, while ChatGPT's growth appears more measured and sustainable.

Market Impact of Disruptive Technologies

The comparison underscores how transformative technologies reshape equity markets. Netscape opened the internet to mainstream users, laying groundwork for e-commerce, search engines, and social platforms. Similarly, ChatGPT and generative AI are revolutionizing industries through workflow automation, productivity gains, and new business models. Current rally drivers include rapid enterprise AI adoption, surging GPU demand creating a semiconductor boom, massive cloud infrastructure investments from tech giants like Microsoft, Google, and Amazon, and renewed investor confidence despite economic uncertainties.

Key Differences from the Dot-Com Era

The late 1990s bubble eventually burst, destroying many speculative internet companies. Today's AI rally differs significantly because it's powered by established, profitable corporations like Nvidia, Microsoft, and Alphabet rather than unproven startups. This foundation of strong fundamentals could make the current trend more durable, though short-term volatility remains likely.

Usman Salis

Usman Salis

Usman Salis

Usman Salis