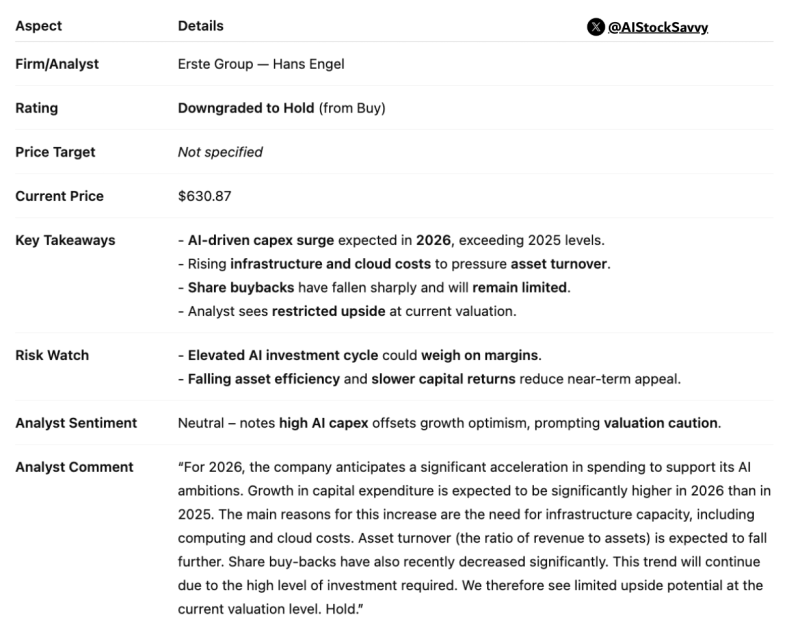

Meta Platforms is facing a reality check on Wall Street. Erste Group recently downgraded the stock to Hold, pointing to surging AI expenses and limited room for gains. The move highlights growing concerns that Meta's aggressive push into artificial intelligence might squeeze profits before delivering meaningful returns.

AI Capex Surge Triggers Downgrade

Erste Group downgraded Meta Platforms (META) from Buy to Hold, citing a dramatic ramp-up in AI spending expected through 2026.

The company is preparing for capital expenditures that will exceed even this year's elevated levels, driven by massive computing infrastructure needs and large-scale AI development.

Buyback Cuts Remove Key Stock Support

The numbers tell a clear story: Meta's share buybacks have dropped sharply and are expected to stay low as cash gets redirected into long-term AI projects. That's a problem because buybacks have been a major driver of the stock's recovery over the past two years, propping up valuations when other metrics looked shaky.

Efficiency Concerns Mount as Spending Outpaces Revenue

There's also concern about efficiency. As Meta pours billions into infrastructure and cloud services, its asset turnover is likely to take a hit. When spending outpaces revenue growth in the short term, investors get nervous about whether all that money is actually being put to good use.

Key concerns for investors include:

- Skyrocketing AI capex expected to accelerate significantly in 2026

- Declining share buybacks removing a critical source of stock support

- Falling asset turnover as infrastructure costs grow faster than revenue

- Margin pressure from elevated investment cycles weighing on profitability

- Slower capital returns dampening the company's financial appeal

Neutral Outlook Despite Strong Fundamentals

Despite Meta's strong fundamentals, the analyst sentiment has shifted to neutral. The issue isn't whether Meta's AI strategy makes sense long-term — it's whether the company can justify its current valuation while burning through capital at this pace. The downgrade reflects growing skepticism that near-term returns can keep up with rising costs.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi