In 1999, he sold the company to found the Pabrai Investment Fund. It has outperformed the S&P 500 by more than 1100% since 2000, turning its owner into a household name in the business world.

Key facts about Pabrai and his venture:

- He is one of the world’s most successful value investors. He achieved this by following Warren Buffett’s example.

- He founded the Dakshana Foundation to fight poverty in developing countries, including his home country, India.

- Pabrai Investment controls around half a billion dollars. The fund has constantly gone over the benchmark, earning profits for both its owner and its investors.

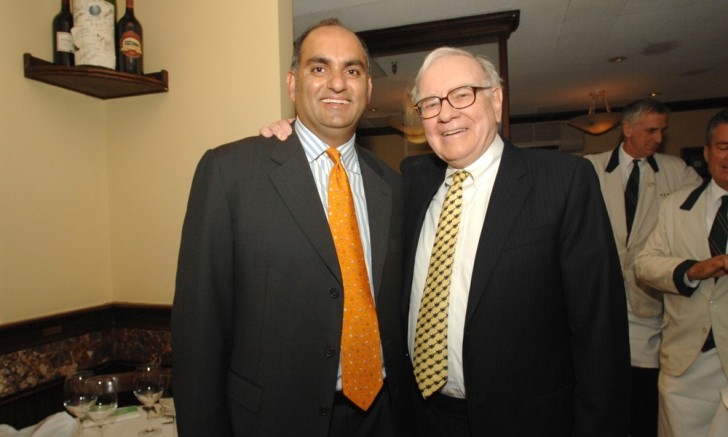

Buffett’s greatest apprentice

Pabrai has been highly influenced by the works and actions of Warren Buffett. He has sought to learn from the world-renowned investor, going as far as to pay $650,000 for a lunch with Buffett.

Pabrai’s investing steps in the stock market are in tune with Buffett’s value investment theory. However, Pabrai started his entrepreneurial aspirations at a much later stage in life compared to Buffett. So, what made him so successful despite learning about the investor only after 30? He followed all of Buffett’s principles to the letter, developing an obsession with the businessman.

In his book The Dandho Investor, Pabrai detailed his investing philosophy. He states that a low-risk, high-uncertainty approach is the most profitable one. When the market mixes up risk with uncertainty, undervaluing certain stocks, a witty investor should strike and gain profit as a result. In short, investors should have the mentality of entrepreneurs.

Furthermore, one should invest in areas where there is little to no change over time, according to Pabrai. There is much less risk involved than investing in a startup, and it is possible to get profit even if the investor makes incremental changes in his business strategy. In Pabrai’s own words: ‘looking for the mundane eliminates 99% of other investment alternatives.’

He created a series of questions that would help any investor make the right decision regarding a certain investment. They read as follows:

- Do I know the business enough, and am I competent enough for it?

- Do I understand the intrinsic value of the business in the present moment? Do I think its inherent value is truly high? How would this value change in the future?

- Is the stock undervalued, and will it remain undervalued for the next 2-3 years?

- If this is a venture I must invest in, will I do so using a large part of my wealth?

- In case of a downside, how much would this investment affect me?

- Can the business handle facing competition and still make a substantial profit?

- How reliable and credible is the company’s management?

Pabrai’s investment philosophy can be summarised by his quote: ‘Heads I win, tails I will not lose much.’ This means that an investor should choose the stocks with the least risk possible while ensuring that they provide a sizable return. An investor should focus on the following:

- Never invest in startups, just like Warren Buffett.

- Looking for businesses in industries that change very slowly.

- Looking for businesses in distressed industries where safety results in great value opportunities.

- Making sure to invest in competitive businesses, these are Buffett’s most desired.

- Throwing money out when the odds are in the investor’s favor and waiting for a sizable return on investment.

- Buying in undervalued businesses that are likely to stay this way for a couple of years.

- Investing in high-uncertainty, low-risk businesses since the market does not value these businesses as much as it should.

- Watching for arbitrage moments when certain stocks become extremely profitable for a short period of time.

Pabrai also notes that picking stocks with a low P/E ratio could be the key to the success of any investor. He is used to picking up such stocks, widening the rate of success by focusing on oversold instruments and getting returns that are unimaginable otherwise.

Sincerest form of flattery

Pabrai does not view investing as a competition for creativity. He simply imitates the steps taken by other investing experts.

He follows value managers of Berkshire, Longleaf, Baupost, Greenlight, Pershing, Partners III Opportunity, and other reputable funds, citing a College of Nevada research study conducted by Martin and Puthenpackal. Within it, investors following Warren Buffett’s steps outperformed the market by 11% over a 31-year timeframe.

Pabrai is the founder of one of the world’s leading charities, the Dakshana Foundation. This charity organization focuses on alleviating poverty. Although the founder himself does not make a big deal out of it, saying that he got rich easily would be incorrect: Pabrai managed to survive the September 2008 worldwide crash despite losing 60% of his net worth.

His resilience and wits are why he thrives today after a loss that would have been crippling to other investors.

Peter Smith

Peter Smith

Peter Smith

Peter Smith