- 1. Value Investing: The Foundation of Buffett's Philosophy

- 2. Focus on Long-Term Growth: Patience is Key

- 3. Invest in What You Know: Stick to Your Circle of Competence

- 4. Buy Low, Sell High: Contrarianism and Opportunism

- 5. Avoid Herd Mentality: Don't Follow the Crowd

- 6. Risk Management: Diversification and Margin of Safety

- 7. Emphasize the Management: Look for Honest and Competent Leaders

- 8. Keep It Simple: Avoid Complexity and Obscurity

- Conclusion: Applying Buffett's Principles to Your Investment Strategy

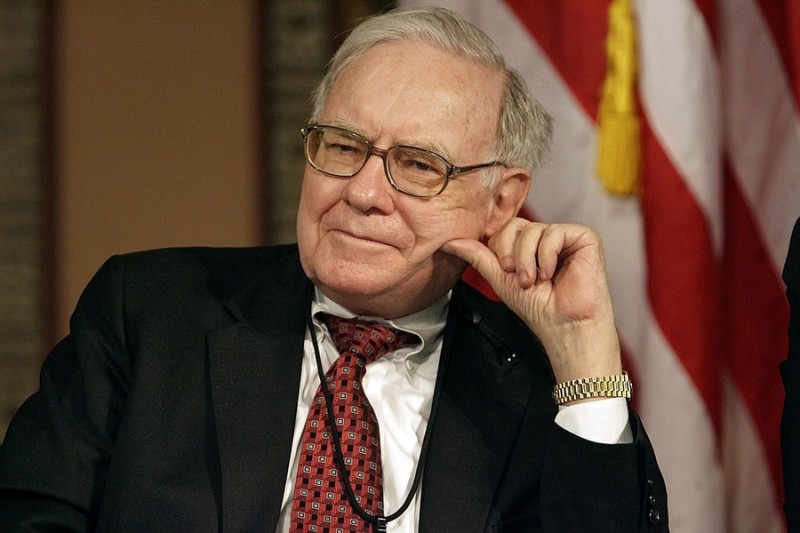

Warren Buffett, also known as the Oracle of Omaha, is one of the most successful investors of all time. He is the CEO of Berkshire Hathaway and has a net worth of over $100 billion.

Buffett is known for his unique investing style and has become an inspiration to many investors around the world. In this article, we will explore the investing principles that have made Warren Buffett so successful.

Buffett's investment strategy is based on fundamental analysis, long-term thinking, and a focus on value. In this article, we will explore seven of Buffett's trading principles that have helped him achieve remarkable success in the stock market.

By learning these principles and applying them to your own trading strategy, you can increase your chances of success in the market.

1. Value Investing: The Foundation of Buffett's Philosophy

One of the most important principles in Buffett's investing philosophy is value investing. Value investing involves looking for stocks that are undervalued by the market.

Buffett looks for companies with strong fundamentals, such as a low price-to-earnings ratio, a high return on equity, and a low debt-to-equity ratio. He believes that the market sometimes undervalues good companies, and he looks for these undervalued opportunities.

Buffett's approach to value investing is to find companies that are trading at a discount to their intrinsic value. He believes that a company's intrinsic value is determined by its earnings power, and he looks for companies that have a sustainable competitive advantage.

This competitive advantage could be a strong brand, a low-cost production process, or a unique product.

2. Focus on Long-Term Growth: Patience is Key

Buffett is a long-term investor and believes in the power of compounding. He looks for companies that have the potential to grow their earnings over the long term. He invests in companies that have a strong competitive advantage, which allows them to generate high returns on capital for years to come.

Buffett believes that patience is the key to successful investing. He doesn't try to time the market, and he doesn't get distracted by short-term fluctuations in stock prices. Instead, he focuses on the long-term growth prospects of the companies he invests in.

He also believes in holding on to his investments for the long term, allowing the power of compounding to work in his favor.

3. Invest in What You Know: Stick to Your Circle of Competence

Buffett advises investors to stick to what they know. He believes that investing in businesses outside of your circle of competence can be risky. He advises investors to focus on industries and companies that they understand.

By investing in businesses that you know, you can better evaluate their growth prospects, competitive advantage, and management team.

Buffett's circle of competence includes industries such as insurance, banking, and consumer goods. He has also invested in technology companies like Apple and IBM, but only after gaining a deep understanding of their business models and competitive advantages.

4. Buy Low, Sell High: Contrarianism and Opportunism

Buffett believes in buying low and selling high. He is a contrarian investor and looks for opportunities where others see risk. He believes that the best time to buy is when the market is pessimistic about a company's prospects. This is when stocks are undervalued and offer the most potential for long-term growth.

Buffett also believes in opportunistic investing. He looks for companies that are facing temporary setbacks, but have the potential to recover in the long term. He invests in companies that have a strong competitive advantage and can weather short-term challenges.

5. Avoid Herd Mentality: Don't Follow the Crowd

Buffett believes in avoiding herd mentality. He doesn't follow the crowd and doesn't get swayed by short-term market trends. He advises investors to think independently and make their own investment decisions.

Buffett believes that investing is about buying the right companies at the right price. He doesn't get caught up in market hype and doesn't invest in companies just because they are popular.

6. Risk Management: Diversification and Margin of Safety

Buffett believes in managing risk through diversification and margin of safety. He advises investors to diversify their portfolios to reduce the risk of losses.

He also looks for companies that have a margin of safety, which means that their stock price is trading at a discount to their intrinsic value. This provides a cushion against potential losses.

Buffett also believes in limiting his losses. He doesn't invest more than he can afford to lose, and he doesn't take on unnecessary risks. He believes that investing is about managing risk, and he focuses on minimizing his downside risk.

7. Emphasize the Management: Look for Honest and Competent Leaders

Buffett places a strong emphasis on management when evaluating companies. He looks for companies with honest and competent leaders who have a track record of success. He believes that a company's management team is one of the most important factors in its long-term success.

Buffett also looks for companies with a strong corporate culture. He believes that a strong culture is important for creating a sustainable competitive advantage. He looks for companies that prioritize their employees, customers, and shareholders, and that have a long-term focus.

8. Keep It Simple: Avoid Complexity and Obscurity

Buffett believes in keeping investing simple. He advises investors to avoid complex investments that they don't understand. He also advises against investing in companies with complicated business models or financial statements. He believes that simplicity is the key to successful investing.

Buffett also believes in transparency. He looks for companies that are transparent in their financial reporting and that provide clear and concise information to investors. He believes that transparency is important for building trust with investors and for creating a sustainable business model.

Conclusion: Applying Buffett's Principles to Your Investment Strategy

Warren Buffett's investing principles have made him one of the most successful investors of all time. His value investing approach, long-term focus, and emphasis on management have helped him identify some of the best investment opportunities in the market.

By applying Buffett's principles to your own investment strategy, you can increase your chances of success in the market. Remember to focus on value, stay patient, invest in what you know, be opportunistic, avoid herd mentality, manage risk, emphasize management, and keep it simple.

Peter Smith

Peter Smith

Peter Smith

Peter Smith