⬤ Zeta Global (ZETA) is finally addressing one of its biggest investor concerns: excessive stock-based compensation. The company's equity awards have dropped 57% from their 2021 highs, and dilution is projected to fall to just 3-4% by 2026. This shift comes as Zeta continues generating solid free cash flow on a trailing twelve-month basis, with recent data showing both metrics trending in favorable directions.

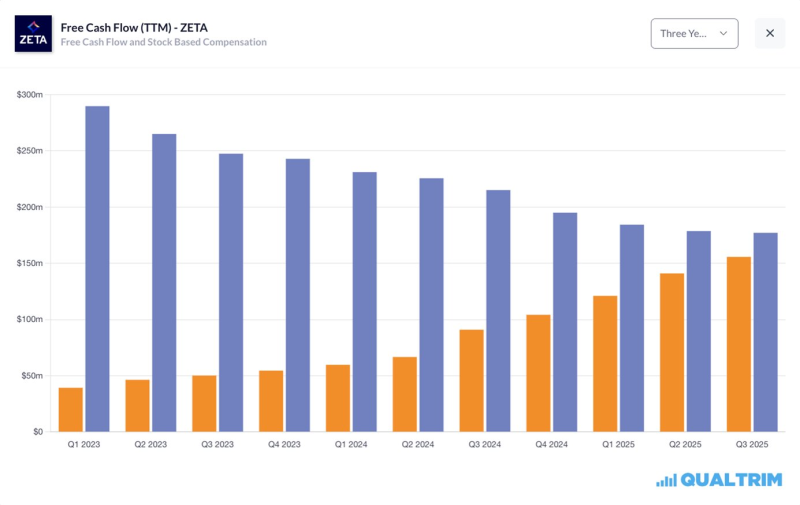

⬤ The financial picture tells an interesting story. Zeta's trailing twelve-month free cash flow has stayed positive throughout the 2023-2025 period, moving from around $200 million in early 2023 to roughly $180-190 million by 2025. Meanwhile, stock-based compensation has been climbing quarter by quarter during this window, but here's the key point: these current levels remain well below the 2021 peaks. That 57% reduction from those earlier highs represents real progress on what had been one of the company's most scrutinized expense lines.

⬤ The expected drop in equity dilution to low single digits by 2026 marks a major turning point. For years, dilution and stock compensation hung over Zeta Global like a dark cloud, affecting how investors viewed the company's financials and limiting shareholder base growth. Now the numbers show a clearer alignment between operating performance and compensation structure. Free cash flow remains stable while the cost of equity awards is finally coming under control.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah