Tesla's electric vehicles face decreasing demand in California, dropping 15.1% year-over-year in Q1 2025, marking the sixth consecutive quarter of declining registrations despite overall growth in new car sales across the state.

Tesla's registrations in California fell by 15.1% year-over-year in the first quarter of 2025, continuing a troubling trend for the electric vehicle manufacturer. This marks the sixth consecutive quarter of declining sales in what has traditionally been one of Tesla's strongest markets. The drop is particularly concerning because it occurred while total new car registrations in California increased by 8.3% during the same period, according to data from Experian Automotive.

The California New Car Dealers Association (CNCDA) highlighted this divergence, noting that Californian consumers appear to be increasingly turning away from Tesla vehicles. The association suggested that CEO Elon Musk's controversial public persona might be contributing to this shift in consumer preferences.

The ongoing decline has significantly impacted Tesla's dominance in California's Zero Emission Vehicle (ZEV) market. By the end of Q1 2025, Tesla's share of the ZEV market in California had fallen to 43.9%, representing an 11.6% decrease. This marks a critical milestone as Tesla's share has now dropped below half of all ZEV sales in the state for the first time in recent years.

This deterioration in Tesla's position has had broader implications for the entire ZEV market in California. The overall market share for zero-emission vehicles has regressed to 20.8% of total car sales, down from 22% during the same period last year. This regression presents a challenge to California's ambitious environmental goals and ZEV adoption targets.

CNCDA Chairman Robb Hernandez emphasized that car dealers are primarily focused on meeting customer demand, stating that the decline in Tesla sales demonstrates that government mandates alone cannot drive EV adoption if consumer interest is lacking.

Tesla (TSLA) Falls to Third Place in Overall California Car Market

Looking at the broader automotive market in California, Tesla now ranks third with a 9.1% market share, behind Japanese automakers Toyota and Honda. Toyota leads the market with a 16.5% share, while Honda holds the second position with 10.8%. Tesla's third-place standing, while still impressive for a relatively young automaker, represents a concerning trajectory given its recent sales decline.

For the entirety of 2025, California's total car registrations are projected to decrease by 2.3%, totaling approximately 1.71 million vehicles. This broader market contraction could further complicate Tesla's efforts to reverse its declining sales trend in the state.

The shift in buyer preferences away from Tesla vehicles poses significant challenges for meeting California's ambitious electric vehicle adoption goals. As the state continues to push for increased ZEV market share through regulatory frameworks, the declining interest in the market's leading electric vehicle brand suggests that achieving these targets may be more difficult than previously anticipated.

Tesla (TSLA) Stock Analysis Shows Mixed Sentiment Among Analysts

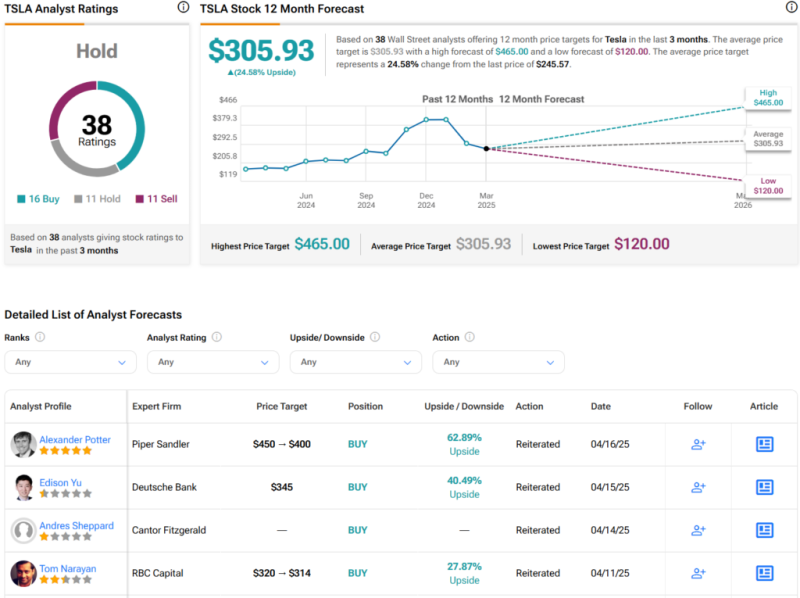

Wall Street analysts currently maintain a Hold consensus rating on Tesla stock, reflecting the mixed outlook for the company. This assessment is based on 16 Buy, 11 Hold, and 11 Sell ratings assigned over the past three months. Despite the challenges in the California market, analysts still see potential upside for the stock.

The average price target for Tesla shares stands at $305.93, suggesting a potential upside of 24.6% from current levels. This indicates that while there are concerns about Tesla's market position in California, many analysts still believe in the company's long-term growth prospects in the broader global market.

The contrasting views among analysts reflect the complex dynamics affecting Tesla's business. While the company faces challenges in mature markets like California, its international expansion and product diversification strategies may offset some of these difficulties. Investors are closely monitoring how Tesla responds to changing consumer preferences and increasing competition in the electric vehicle segment.

Peter Smith

Peter Smith

Peter Smith

Peter Smith