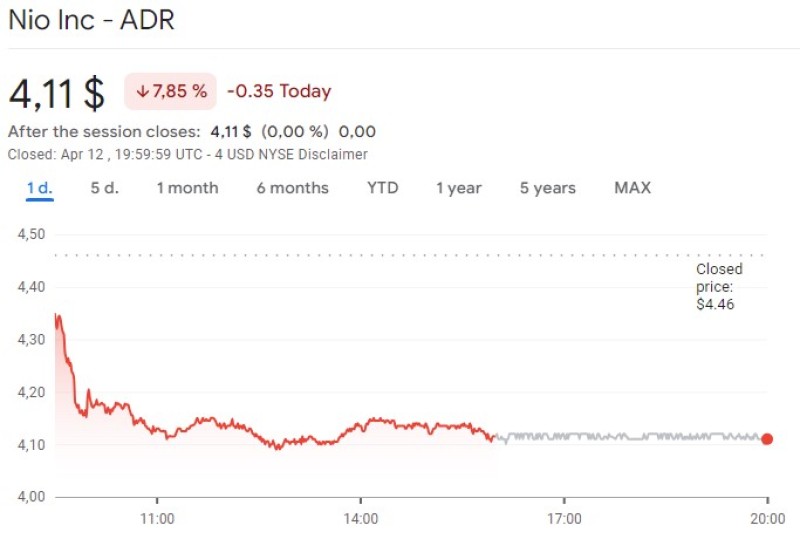

NIO (NYSE:NIO) shares decline by 7.85% as analysts revise price targets downwards, reflecting investor concerns.

NIO Stock Price Downturn Amid Analyst Revisions

Nio Inc – (NYSE:NIO) witnessed a 7.85% drop in its stock price on Friday, trading as low as $4.11 before settling at $4.13. This downturn saw approximately 33,483,281 shares changing hands, marking a 41% decrease from the average daily volume of 56,356,891 shares. The stock had previously closed at $4.46.

Recent research reports have drawn attention to NIO's performance. JPMorgan Chase & Co. lowered their price objective to $4.80, rating the stock as "underweight." Similarly, Jefferies Financial Group adjusted its price target to $5.90, maintaining a "hold" rating. Barclays reaffirmed an "underweight" rating, setting a $4.00 price target, while UBS Group revised their target to $7.20, rating the stock as "neutral."

Sanford C. Bernstein also adjusted their price target to $5.50, maintaining a "market perform" rating. With two analysts rating the stock as "sell," seven as "hold," and one as "buy," MarketBeat reports an average rating of "Hold" with a consensus price target of $8.74.

NIO Stock Performance and Financial Indicators

NIO's 50-day moving average price stands at $5.36, while its 200-day moving average is $6.87. With a market cap of $7.07 billion and a price-to-earnings ratio of -2.35, the firm faces a beta of 1.93. Its debt-to-equity ratio is 0.51, with a current ratio of 1.22 and a quick ratio of 1.13.

The company's last quarterly earnings report, released on March 5th, revealed earnings per share (EPS) of ($2.81), falling short of the consensus estimate of ($2.39). Despite posting revenue of $17.10 billion, slightly below analyst estimates of $18.16 billion, NIO experienced a negative return on equity of 110.72% and a negative net margin of 38.09%. Analysts anticipate Nio Inc – will post -1.26 earnings per share for the current year.

Institutional Investors React to NIO's Performance

Recent movements in NIO's stock have attracted attention from institutional investors. Point72 Asset Management L.P., Bfsg LLC, Rakuten Securities Inc., Principal Securities Inc., and Peoples Bank KS are among the entities that have acquired stakes in NIO, contributing to institutional investors and hedge funds now owning 48.55% of the company's stock.

In conclusion, the downward trajectory of NIO's stock price, coupled with analysts' revised price targets, underscores the challenges facing the company. Despite institutional investor activity, NIO must address concerns regarding its financial performance to regain market confidence and stability.

Peter Smith

Peter Smith

Peter Smith

Peter Smith