NIO Inc. experienced a significant sell-off from institutional investor Legal & General Group Plc, which reduced its position by 42.7% while the electric vehicle manufacturer continues to face challenges in the market with its stock price and analyst ratings.

Legal & General Group Plc has substantially reduced its position in NIO Inc. (NYSE) by 42.7% during the fourth quarter, according to the company's recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor sold 4,702,959 shares during the quarter, leaving it with holdings of 6,301,731 shares of the company's stock. Legal & General Group Plc owned approximately 0.30% of NIO, with these remaining shares valued at $27,507,000 as of its most recent SEC filing.

This significant reduction in holdings by a major institutional investor comes amid ongoing challenges for the Chinese electric vehicle manufacturer in both domestic and international markets. Legal & General's decision to substantially cut its NIO position could signal concerns about the company's near-term performance or strategic direction.

Other Institutional Investors Adjust NIO Positions

Legal & General Group Plc is not the only institutional investor making moves regarding NIO stock. Several other hedge funds and institutional investors have recently modified their holdings in the company. Notable transactions include Arizona PSPRS Trust, which purchased a new stake in NIO shares worth approximately $1,330,000, and Trexquant Investment LP, which invested around $3,305,000 in the company.

Franklin Resources Inc. increased its stake in NIO by 20.4% during the fourth quarter, adding an additional 2,788 shares to bring its total holdings to 16,486 shares valued at approximately $72,000. O'Shaughnessy Asset Management LLC also raised its position in NIO by 28.9%, now holding 41,104 shares worth $179,000. Additionally, Orion Portfolio Solutions LLC established a new position valued at $93,000.

Currently, institutional investors and hedge funds collectively own 48.55% of NIO's stock, showing continued, though cautious, institutional interest in the Chinese EV manufacturer despite market challenges.

NIO Stock Performance Shows Volatility Amid Market Uncertainty

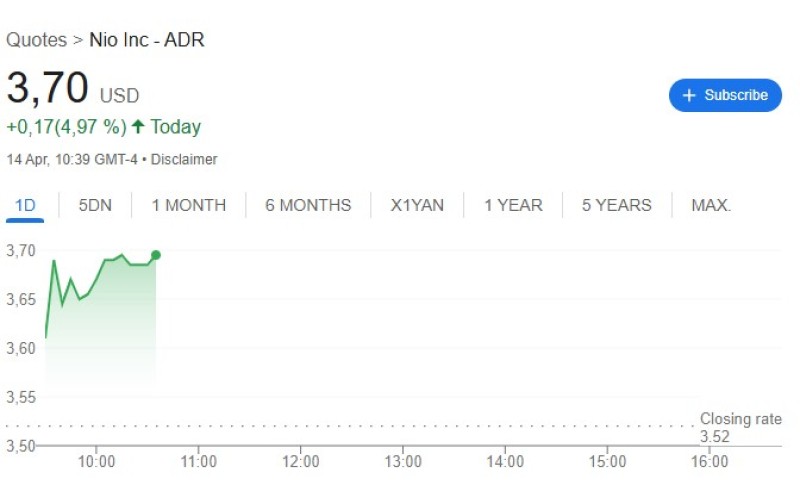

NIO's stock has shown significant volatility in recent trading sessions. As of the most recent market close, NYSE

opened at $3.50 on Monday, marking a 6.6% increase for the day. This price movement comes within a broader context of fluctuation, with the company experiencing a 52-week low of $3.02 and a 52-week high of $7.71.

The current market capitalization of NIO stands at approximately $7.30 billion, with a price-to-earnings ratio of -2.32 and a beta of 1.74, indicating higher volatility compared to the broader market. The company maintains a quick ratio of 0.93 and a current ratio of 1.04, with a debt-to-equity ratio of 0.98.

Looking at longer-term price movements, NIO has seen a downward trend with a 200-day moving average of $4.67 and a more recent 50-day moving average of $4.23, reflecting ongoing challenges in maintaining stock price stability in an increasingly competitive EV market.

NIO Financial Performance Falls Short of Analyst Expectations

NIO's latest quarterly earnings results, released on Friday, March 21st, revealed mixed financial performance. The company reported earnings per share (EPS) of ($0.47), missing the consensus estimate of ($0.33) by $0.14. This earnings disappointment has added to investor concerns about the company's path to profitability.

For the quarter, NIO generated revenue of $2.70 billion, which represented a 15.2% increase year-over-year. However, this figure fell significantly short of analyst expectations, which had projected revenue of approximately $20.19 billion. The company continues to face profitability challenges, with a negative net margin of 33.41% and a negative return on equity of 113.83%.

By comparison, during the same quarter in the previous year, NIO reported earnings per share of ($2.81), indicating some improvement in its financial situation despite the ongoing losses. Analysts currently predict that NIO will post earnings of ($1.43) per share for the current fiscal year, suggesting continued financial challenges ahead.

Analyst Ratings for NIO Reflect Market Uncertainty

The analyst community has shown increasingly cautious sentiment toward NIO stock. JPMorgan Chase & Co. downgraded NIO from an "overweight" rating to a "neutral" rating and decreased its price target from $7.00 to $4.70 in early February. Similarly, Citigroup reduced its price target from $8.90 to $8.10 while maintaining a "buy" rating in late March.

HSBC revised its recommendation from a "strong-buy" to a "hold" in early January, joining several other firms taking a more conservative position on the stock. Mizuho also adjusted its outlook, lowering its target price from $4.20 to $3.50 while maintaining a "neutral" rating.

The current analyst consensus for NIO presents a mixed picture: one analyst has issued a "sell" rating, eight have given "hold" ratings, one maintains a "buy" rating, and one has assigned a "strong buy" rating. This distribution of recommendations results in an average rating of "Hold" with an average price target of $5.05 per share, suggesting limited upside potential from current trading levels.

These analyst adjustments reflect broader concerns about NIO's ability to navigate challenges in the competitive electric vehicle market, particularly as it faces potential headwinds from U.S.-China trade tensions and increasing competition from both domestic and international EV manufacturers.

Usman Salis

Usman Salis

Usman Salis

Usman Salis