- NIO Hitting a Make-or-Break Point as Trend Lines Converge

- NIO Moving Averages Show the Tide Is Turning

- NIO Technical Indicators Flashing Green Despite Recent Wobbles

- NIO Business Fundamentals Hold Up Well Despite Earnings Hiccups

- NIO Recovery Case Strengthened as Technical and Fundamental Pieces Fall into Place

China's EV player NIO is showing some seriously promising signs of an upside breakout, even after dropping 22% since last fall. The company's impressive delivery growth and better gross margins make for a pretty solid foundation beneath this technically oversold stock.

NIO Hitting a Make-or-Break Point as Trend Lines Converge

NIO is at a critical crossroads with two key trend lines about to collide. The stock's been stuck in a downtrend since early March, which kept pushing prices down through late April. But there's a newer uptrend that's formed since the early April bottom, which has been keeping the stock from falling further these past few trading days.

With these opposing forces now meeting, NIO looks ready to break decisively in one direction. Looking at the May 12th pre-market action, we're seeing some solid gains that could push the stock through that stubborn downtrend resistance line, potentially confirming what the technical indicators have been hinting at – a recovery is brewing.

Keep an eye on that mid-$3.60s support level – it's been crucial, acting as a floor in late March and a ceiling in mid-April. If the bears regain control, that's the level to watch.

NIO Moving Averages Show the Tide Is Turning

While NIO's long-term moving averages still look bearish after that death cross back in December (when the 50-day SMA dropped below the 200-day SMA), the short-term picture is brightening up nicely. The 9-day EMA crossed above the 21-day EMA in late April – a classic signal that upward momentum is building.

The stock looks set to jump above its 50-day SMA in the May 12th session, which would be a pretty big deal for sentiment. The Bollinger Bands are backing this up too – NIO pushed above the midline in late April, which tells us the selling pressure was easing off. That midline has since become a floor for the stock, setting up a nice foundation for more gains.

As one analyst put it: "The Bollinger Bands suggest a breakout above the downtrend line is looking more and more likely, especially with the midline acting as support these past few days." That's a pattern worth paying attention to if you're looking for upside movement.

NIO Technical Indicators Flashing Green Despite Recent Wobbles

The MACD (Moving Average Convergence Divergence) is showing some persistent bullish momentum despite the recent choppiness. Sure, the histogram briefly flipped red at the end of April, but the MACD has held above its signal line – a good sign that there's still gas in the tank for more upside.

The RSI currently sits at 50.88, which puts NIO in neutral territory but still under the bulls' control by a hair's breadth. That's a decent recovery from early April when the RSI crashed below 30, entering oversold territory.

The stochastics did show a bearish crossover in late April with both lines sinking below 50, but a bullish flip looks just around the corner. The expected strength in upcoming trading should push the faster %K line back above the slower %D line, reinforcing the broader recovery pattern we're seeing.

Looking at the Fibonacci Retracement levels, NIO is currently sitting right at the 38.2% retracement level (measured from the early March high to the early April low). With momentum picking up, the stock looks ready to test the psychologically important 50% retracement level, which would add more weight to the recovery story.

NIO Business Fundamentals Hold Up Well Despite Earnings Hiccups

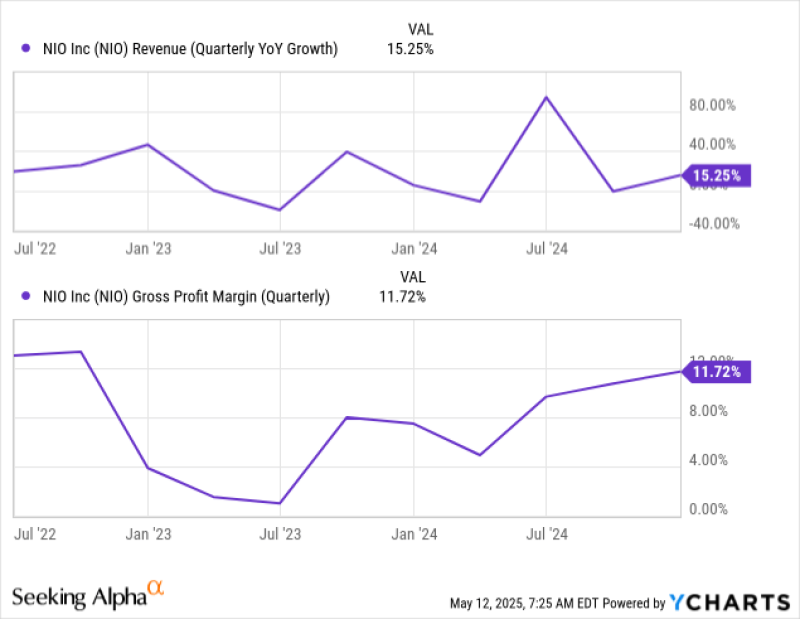

While the technical charts are pointing to a recovery, NIO's fundamental picture adds more fuel to the bullish case. The company pulled in Q4 2024 revenues of $2.7 billion, up 15.2% year-over-year. Vehicle sales hit $2.4 billion, growing 13.2% compared to the same period last year.

What's really impressive is NIO's delivery numbers – they shipped 72,689 vehicles in Q4, a robust 45.2% jump year-over-year. Yes, they reported an adjusted loss of $0.43 per ADS (missing estimates by $0.11), but their gross margin improved substantially, climbing from 7.5% to 11.7% compared to last year.

Looking forward, NIO's guidance for Q1 2025 is calling for deliveries between 41,000 and 43,000 vehicles, representing year-over-year growth of 36.4% to 43.1%. Revenue is expected to land between $1.694 billion and $1.762 billion, suggesting growth of 24.8% to 29.8% compared to the same quarter last year – a nice acceleration from Q4's growth pace.

From a valuation angle, NIO is looking increasingly tempting. The Price-to-Sales (P/S) ratio has been crushed over the past three years, falling from above 6.0 in mid-2022 to just 0.891 today. This dramatic multiple compression seems totally disconnected from how the company is actually performing, especially considering the improving gross margins and solid delivery growth.

As one market watcher noted: "I think the multiple contraction has gone too far, even with the EPS misses. The core business is weathering China's economic headwinds pretty well, with delivery growth still at impressive levels."

NIO Recovery Case Strengthened as Technical and Fundamental Pieces Fall into Place

The combination of technical signals and fundamental performance makes a pretty compelling case for NIO comeback. While the stock's been under pressure since fall 2024, both the technical patterns and business metrics suggest investors have been too pessimistic.

The converging trend lines, bullish signals from key technical indicators, and significant improvements in deliveries and gross margins all suggest we're approaching a turning point. With the stock trading at valuation levels that seem to ignore its operational progress, NIO looks like an interesting opportunity for investors willing to bet on the gap between price action and business performance closing.

As the technical picture brightens and delivery numbers continue to show resilience despite China's economic challenges, NIO appears well-positioned for a meaningful recovery from current levels. Smart investors will be watching the stock's behavior around key technical levels – particularly that downtrend line resistance and the 50% Fibonacci retracement – for confirmation that the bulls are back in charge.

Usman Salis

Usman Salis

Usman Salis

Usman Salis