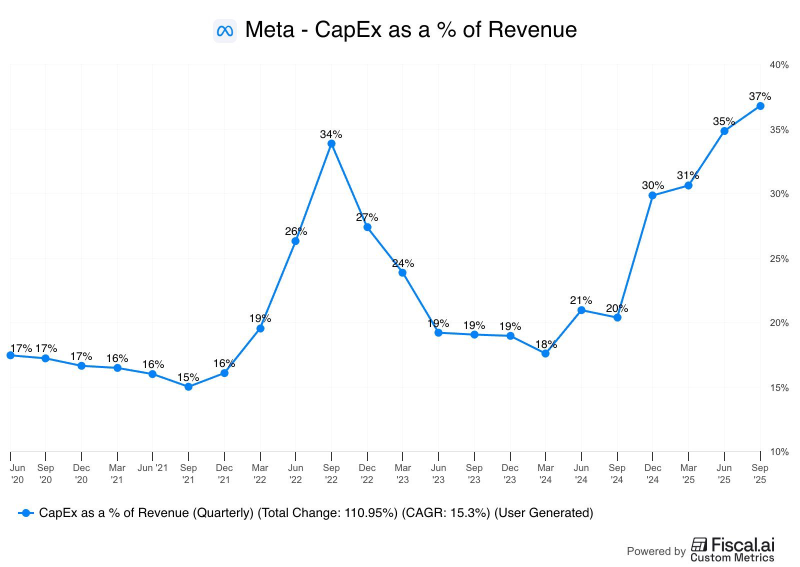

⬤ Meta's stock has dropped as the company pours money into AI infrastructure at levels not seen since the 2021 metaverse spending peak. Capital expenditures have climbed steadily through 2024 into 2025, driven by data center builds, GPU purchases, and training next-gen AI models. The 37% CapEx-to-revenue ratio has investors questioning whether the short-term pain is worth the long-term gain.

⬤ The spending spree comes at a tricky time. Proposed tax reforms—including higher corporate rates, changes to capital gains, and limits on equipment depreciation—could squeeze companies relying on heavy capital investment. Smaller tech firms may face bankruptcy risk, while Meta could see its reinvestment capacity limited right when it needs it most. There's also concern that taxing stock-based compensation more aggressively could drive top AI talent to friendlier tax jurisdictions.

⬤ Zuckerberg isn't backing down. He's building out compute infrastructure that won't deliver returns for years, betting that whoever controls the AI compute layer will control the internet's future. This mirrors Meta's past playbook: invest heavily when others doubt, then reap rewards later. CapEx has more than doubled since 2020, growing at about 15% annually. While Wall Street is impatient, Meta's leadership is playing the long game—and history suggests that approach has worked before.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah