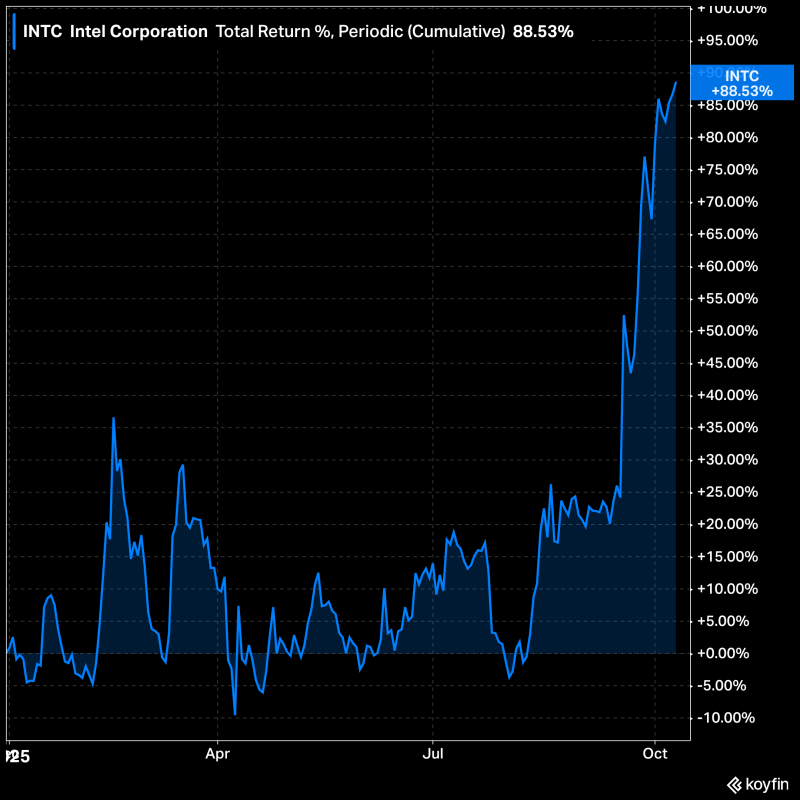

Intel Corporation (INTC) has pulled off quite the comeback in 2025, becoming one of the year's most unexpected success stories in tech. The stock has climbed nearly 89% year-to-date, fueled by growing semiconductor demand, progress in its foundry business, and a wave of renewed investor confidence.

Intel's Impressive 2025 Rally

What started as modest gains earlier this year has transformed into something much bigger. Data from Koyfin trader shows the stock shifted from steady increases to an almost vertical climb through September and October, with options trading picking up significantly as institutions and active traders bet heavily on Intel's revival.

Early in the year, the stock bounced around without clear direction. By summer, Intel pushed past 20% and then 30% gains. But the recent sprint from around 30% to nearly 90% returns really stands out - showing serious momentum and institutional backing. So far, there haven't been any major reversal signals, suggesting the market believes Intel's turnaround is real.

What's Behind the Surge

Several factors are driving Intel's performance. While Nvidia dominates the AI conversation, Intel has been quietly strengthening its position in AI and server chips. The company has made real progress on its manufacturing roadmap and capacity expansion, improving confidence in its long-term competitiveness. Beyond Intel, the entire semiconductor industry is benefiting from strong demand, government support, and better supply chains. The uptick in options volume shows strong speculative interest and hedging activity, both amplifying price movements.

Looking Ahead

If momentum continues, Intel could hit 90% soon and possibly push toward triple-digit returns before year-end. However, such rapid gains bring risks - sharp rallies can lead to volatility and profit-taking. The next earnings report will be crucial in determining whether Intel can maintain this pace and prove its turnaround has staying power.

Peter Smith

Peter Smith

Peter Smith

Peter Smith