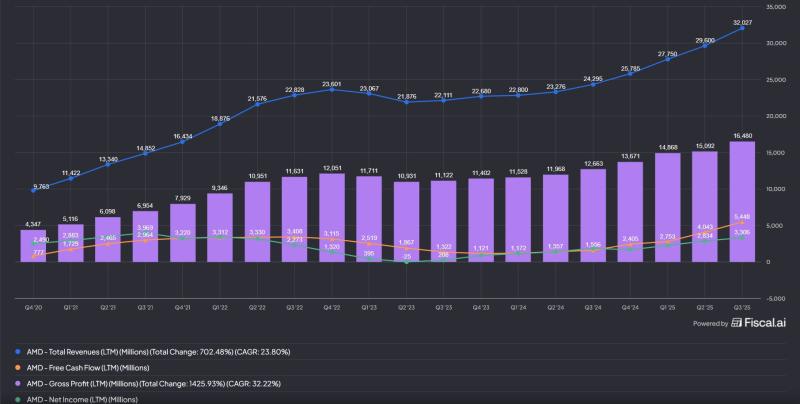

⬤ Recently, Fiscal.ai shared a bullish take on AMD, warning that skeptics might be underestimating just how big the company's growth could be by 2026. His comments are gaining traction as AMD's latest numbers show steady gains in revenue, gross profit, and cash flow heading into 2025. The data paints a picture of a company building real momentum.

⬤ AMD's path to massive revenue growth hinges on one thing: grabbing a solid chunk of the exploding AI chip market. The main risks? Fierce competition from bigger players, execution hiccups in scaling AI hardware, and the chance that businesses adopt AI slower than expected. If things go sideways, smaller chip suppliers could get squeezed, while talent flows to whoever wins the AI race.

⬤ A base case of $70B with 15% AI market share, a bear case of $60B+ with 10% share, and a bull case hitting $70B–$100B if AMD captures 25% of the market. These numbers are a huge jump from where AMD sits today, meaning even moderate success in AI could completely change how the market values the stock.

⬤ AMD's future depends on landing contracts with cloud giants, enterprises, and data centers worldwide. If the latest analysis is right, the company could be entering one of the strongest growth phases in its history—and Wall Street might still be sleeping on it.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah