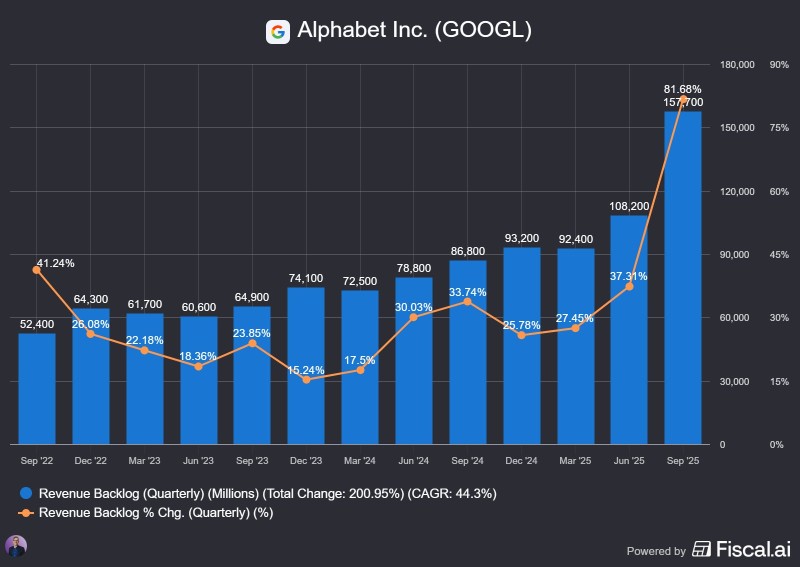

Alphabet Inc. (NASDAQ: GOOGL, GOOG) just hit a serious milestone. The company's revenue backlog has rocketed to $157.7 billion, up 81.7% year-over-year and 46% quarter-over-quarter—the fastest growth in its history. These numbers confirm that Alphabet's AI and cloud contracts are scaling faster than anyone expected, positioning it as one of the biggest winners in the enterprise AI boom.

The Numbers Tell the Story

According to Tannor Manson, this backlog surge reflects an unprecedented wave of large-scale enterprise deals. CEO Sundar Pichai noted that "more deals over $1 billion were signed in the first three quarters of 2025 than in the previous two years combined"—a clear sign that corporate demand for AI infrastructure is accelerating hard.

Alphabet's revenue backlog has jumped from $52.4 billion in Q3 2022 to $157.7 billion in Q3 2025—a 200.95% total increase with a compound annual growth rate of 44.3%. Here's what stands out:

- Steady, then explosive: Between 2023 and mid-2024, backlog grew steadily at 15–33% per quarter. Then 2025 happened. The backlog climbed from $92.4B in Q1 to $108.2B in Q2, then surged to $157.7B in Q3—a 46% quarterly jump.

- Historic acceleration: The 81.68% year-over-year growth in Q3 2025 is the largest in company history, showing how aggressively enterprises are locking in AI infrastructure deals.

- Trend reversal: After two years of moderate growth, the quarterly percentage change spiked upward sharply in 2025, confirming a powerful new phase driven by Google Cloud and Gemini AI solutions.

What's Driving This?

The backlog boom comes from massive enterprise demand for AI infrastructure—think Google Cloud AI, Vertex AI, and Gemini. Companies are pouring money into scalable solutions for workloads, automation, and custom AI apps. This surge marks a shift away from Alphabet's traditional ad revenue toward recurring, multi-year enterprise contracts—a much more predictable and lucrative model.

If Alphabet keeps even half this momentum, its backlog could hit $200 billion by mid-2026, giving it the clearest revenue pipeline in its history. That puts it shoulder-to-shoulder with Microsoft Azure and Amazon Web Services in the race for multi-billion-dollar AI infrastructure deals.

Investors are now watching closely to see how efficiently Alphabet converts this backlog into actual revenue and profit margins—especially as competition heats up.

Alphabet's $157.7B backlog isn't just a record—it's proof that AI is reshaping the company from the inside out. As pointed out, the spike in $1B+ contracts shows global enterprises are going all-in on Google Cloud's AI capabilities. With financial momentum matching strategic execution, Alphabet is entering a new era of scalable, AI-powered growth—one that could define the next decade.

Usman Salis

Usman Salis

Usman Salis

Usman Salis