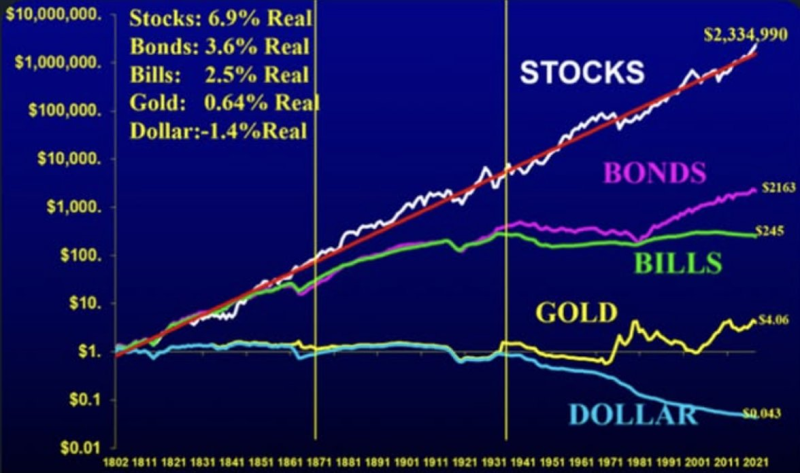

● A chart shared by Dividendology shows just how dominant stocks have been over the long haul. One dollar invested in 1802, adjusted for inflation, would be worth $2,334,900 in stocks today. That same dollar? Just $2,163 in bonds, $245 in Treasury bills, $4.06 in gold, and a measly $0.04 in cash.

● The numbers tell a clear story: stocks returned 6.9% annually on average, while bonds managed 3.6% and gold barely scraped 0.64%. Yes, stocks had brutal crashes—the Great Depression, dot-com bubble, 2008 financial crisis. But patience paid off. Over two centuries, nothing came close to matching equity returns.

● The real danger wasn't market volatility—it was sitting on the sidelines. Conservative assets like bonds and gold protected capital but barely grew it. Cash and gold holders actually lost purchasing power as inflation ate away at their wealth.

● As Dividendology put it: "$1 invested from 1802 to 2021 adjusted for inflation would turn into $2,334,900 in stocks." The lesson is simple: owning productive businesses builds real wealth, while passive assets like gold or currency stagnate.

Peter Smith

Peter Smith

Peter Smith

Peter Smith