Currency valuations in the forex market can rise and fall by the second, creating opportunities for traders. The best forex traders rely on analysis, constant attention, and fast decisions to make profits. However, in recent years, technology has changed how people trade.

Enter automated forex trading. However, this doesn’t mean relying on trading bots to manage your forex account. Instead, you use automation tools to help you analyze market data and execute trades.

For most newbies, this concept can be exciting yet intimidating if you don’t understand how it works.

What Is Forex Automated Trading?

In simple terms, automated trading is about using bots or applications to execute trades. Think of the bots as your little helpers who perform those mundane tasks on your behalf.

The automation software runs using predefined trading rules that are created depending on your needs and trading strategies. The rules can be anything from when to enter and exit a trade to how much money to risk for every trade position.

Once installed, the automation tool monitors the market, searching for conditions that match its programmed logic. When and if the conditions are met, it executes a trade automatically.

The Advantages of Automated Forex Trading

There are many advantages of automated trading forex bots whether you are a newbie or a seasoned trader. Let's look at some of the top benefits of forex brokers using a robot to trade.

§ Eliminating Emotional Bias

Emotions often destroy good trading strategies. Sometimes, traders get too greedy, wanting to make high profits from high-risk trades. A robot trading app, on the other hand, follows its logic strictly, ensuring every trade is executed according to plan.

§ Speed and Precision

Sometimes, prices in the forex market move too fast. Automated trading forex bots can track multiple trades at the same time. In addition, they can execute trades faster than you. This often gives you an edge, allowing you to take advantage whenever possible.

§ 24/7 Operation

It is humanly impossible to stay awake all night watching the market and analyzing trades. This is one of the areas where automation bots excel. You can go to bed knowing your bot will open and close trades based on your strategy.

The Risks and Limitations of Forex Automated Trading

Despite the good, automated trading forex bots have their fair share of shortcomings, which we also need to highlight.

§ Optimizing Too Much

It is easy to get caught up in the moment when developing and testing plans on an automated forex trading app. Sometimes, a strategy can work well during backtests and fail when faced with real-life forex market conditions.

§ Market Volatility

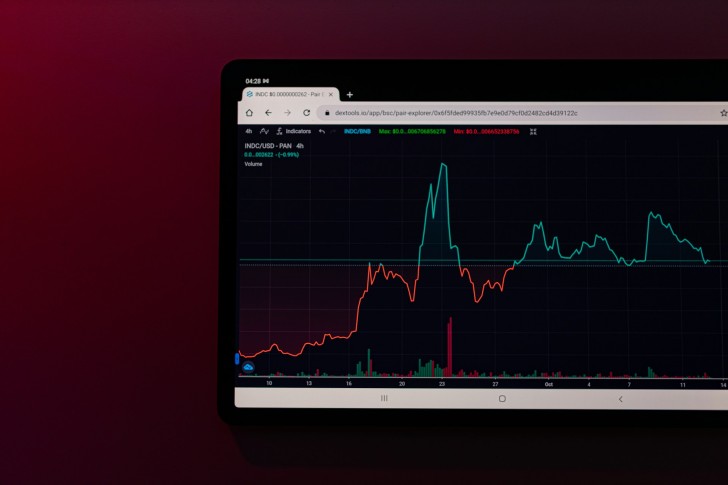

Bots react well when it comes to studying patterns and responding based on your trading plan. However, what happens when the markets are affected by economic news or geopolitical events? Such occasions present a new side where bots may feel out of depth.

§ Relying on Trading Robots Too Much

This is something that creeps in and takes over with time if you aren’t careful enough. Don't let bots do everything. Take time to view things from your perspective, and trust your gut, especially if the markets are moving due to sudden, unpredictable events.

Editorial staff

Editorial staff

Editorial staff

Editorial staff