Knowing your salary is not merely knowing how much you are earning in gross form, but it is how much you are earning in net form, after taxes and deductions. It is the place where a pay calculator 2025 or a payroll calculator UK will be your greatest weapon. Be it an employee attempting to comprehend his payslip or an employer with the goal of carrying out his payroll effectively, the correct salary calculator will ensure that financial planning will be more effortless, transparent, and precise than previously.

The Power of a Pay Calculator 2025

A pay calculator 2025 will help you to break down your salary into each piece, which is the gross pay, income tax, national insurance, pension, and student loan repayments. As the tax regulations are being revised every year, 2025 comes with changes to the threshold and contribution rates that will impact employees and employers alike. A modern pay calculator will keep the figures of your salary up-to-date and will not take you by surprise with how much will be left in your pocket.

A payroll calculator UK is not just a simple calculating tool; it will provide you with an idea of how the progressive tax system in the UK will affect your salary. What you can do is to simulate various situations, such as how your monthly income would change based on the increase in salary, new pension rate, or the adjustment of your student loan plan.

UK Tax System Simplified for 2025

The income tax in the UK is a progressive system in the taxes of 2024 - 25:

- Personal Allowance: This is the amount you earn free of tax, and it is 12570.

- Basic Rate (20%): £12,571 – £50,270

- Higher Rate (40%): £50,271 – £125,140

- Additional Rate (45%): Above £125,140

After your income has exceeded the amount of 100,000 pounds, your Personal Allowance will start to decline, but it will be fully reduced to 125,140. These rules are automatically considered by the payroll calculator UK, and it displays to you the amount of income tax on each band.

National Insurance and Student Loan Repayments

The other significant deduction is National Insurance (NI), which your pay calculator 2025 will consider. The employees will pay at a rate of 12 per cent on income between 12,570 and 50,270 and 2 per cent on income exceeding the same. The employers, on the other hand, make payments of 13.8% on their earnings over 9100.

Provided you have a student loan, the repayment plan is computed as well by the payroll calculator UK:

- Plan 1: £22,015 threshold

- Plan 2: £27,295 threshold

- Plan 4: £31,395 threshold

- Plan 5: £25,000 threshold

The repayments go automatic at a rate of 9 percent of income beyond the threshold; no calculations are required.

How to use a Payroll Calculator UK.

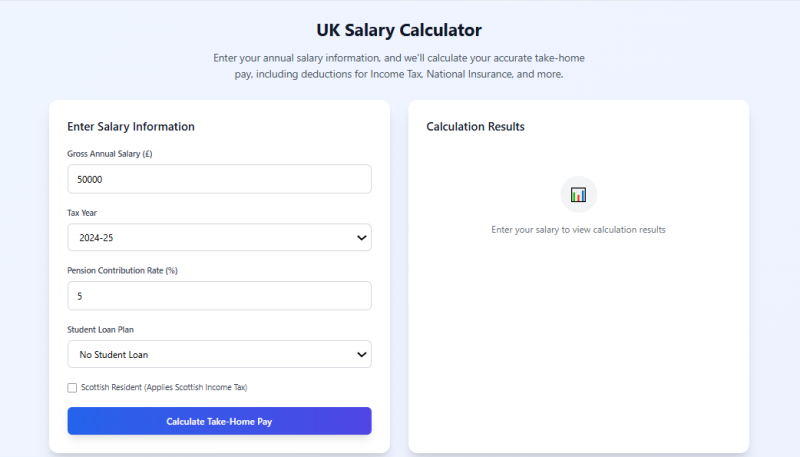

It is easy and fast enough to use a pay calculator 2025 in less than a minute:

- What is your gross salary every year?

- Please choose your tax year (202425), rate of requirements for a pension, and residence.

- Include additional voluntary deductions, e.g., medical or additional pension.

- Check your payroll, taxes, NI, and student loans.

Effective vs. Marginal Tax Rate

The effective tax rate is the total tax you will pay, whereas the marginal tax rate will indicate the amount of tax you will pay on the next pound of income. The two measures are automatically shown in the pay calculator 2025, which assists you in planning pay increases or bonuses most strategically.

Conclusion

Your global financial clarity starts here. Find your exact take-home pay and optimize your plans with our tailored tools—from a powerful payroll calculator UK to our global Pay Calculator 2025 suite, supporting the US, France, Germany, and more. Make confident decisions on pensions, loans, and your next career step.

Editorial staff

Editorial staff

Editorial staff

Editorial staff