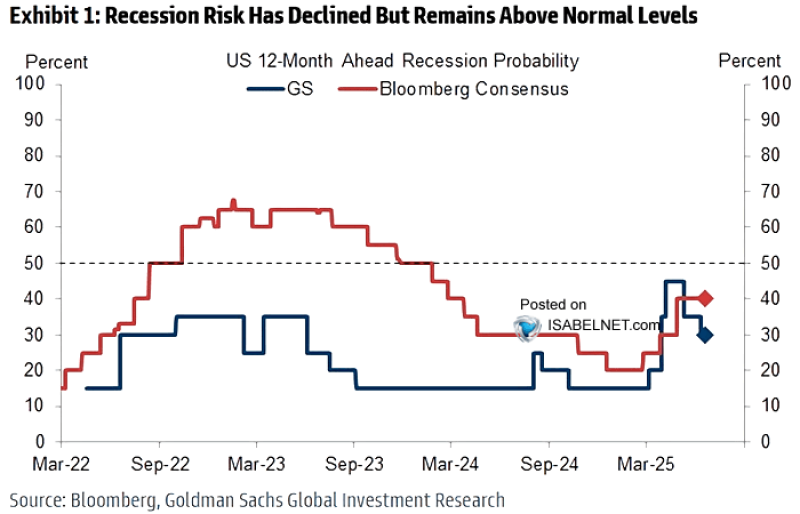

The recession alarm bells are a little quieter now — but they haven’t stopped ringing. According to the latest estimates shared via IsabelNet, the risk of a U.S. recession within the next 12 months is trending lower. Still, it’s not back to normal levels, and a mix of global trade uncertainty and lingering macro headwinds means the outlook remains far from clear.

Risk Levels Are Falling — but Not Disappearing

Two widely followed forecasts — one from Goldman Sachs (GS) and the other from Bloomberg’s consensus — show that recession fears are easing. Goldman now puts the odds at 32% as of March 2025, while Bloomberg’s view sits higher at around 42%. That’s a notable drop from the peak in late 2022 and early 2023, when Bloomberg’s forecast hit a whopping 75%.

Goldman’s outlook has consistently been more optimistic, but even now, neither model suggests we’re in the clear. Recession risks may have cooled, but they’re still above the long-term average — and that’s enough to keep investors cautious.

Trade Tensions Keep the Pressure On

What’s keeping the risk elevated? According to the X post that features the chart, ongoing trade tensions and tariff-related uncertainties are playing a major role. While inflation has moderated and the labor market remains solid, unpredictable shifts in trade policy — especially between the U.S. and major partners like China — continue to cloud the macro picture.

That uncertainty is reflected in the divergence between Goldman’s and Bloomberg’s views. Goldman sees resilience; Bloomberg economists are more wary. For now, it’s a wait-and-see game — and markets are watching every data release closely.

Peter Smith

Peter Smith

Peter Smith

Peter Smith