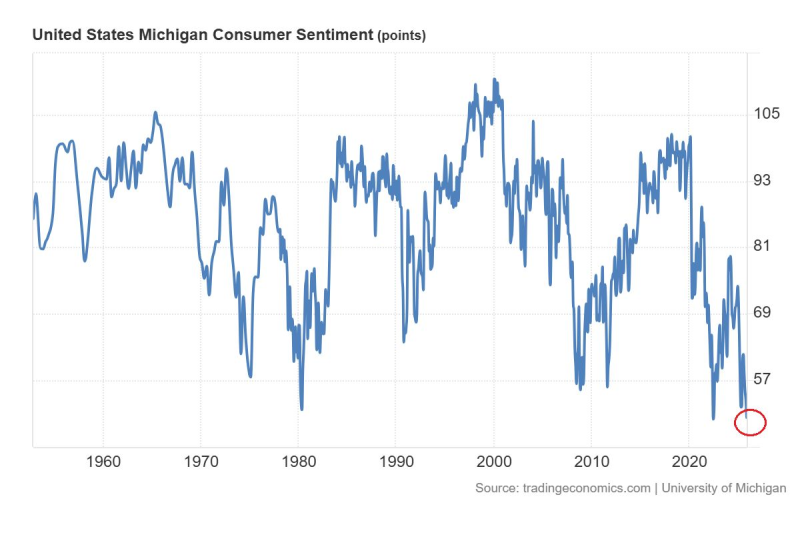

⬤ Recent data from the University of Michigan shows consumer sentiment hitting historic lows, with the index dropping to levels typically seen only during severe economic downturns. The sharp decline reflects mounting household anxiety about the economic outlook, as Americans brace for potentially rougher times ahead. When confidence stays this low for extended periods, both consumers and investors typically shift toward protecting their wealth rather than taking risks.

⬤ Proposed tax changes add another layer of uncertainty to an already fragile economic picture. Some of these policy adjustments could squeeze both businesses and households, potentially pushing struggling companies over the edge or driving skilled workers to seek opportunities elsewhere. With sentiment already shaky, additional financial pressure from tax reforms might trigger more market turbulence and accelerate the move toward defensive investment strategies.

⬤ History shows that when consumer confidence drops this dramatically, demand for tangible stores of value tends to surge. Gold and silver often gain momentum during these periods, as people look for assets that hold their worth when everything else feels uncertain. This pattern becomes especially pronounced when inflation concerns and shifting interest rate expectations make it harder to predict where the economy is heading.

⬤ Markets are responding to this sentiment collapse with increasingly defensive positioning. The chart's dive into critically low territory—a zone not visited in years—suggests households are already pulling back from riskier investments. If this pessimism continues, the flight to safety could reshape investment flows well into next year, with precious metals and other protective assets seeing sustained demand.

Peter Smith

Peter Smith

Peter Smith

Peter Smith