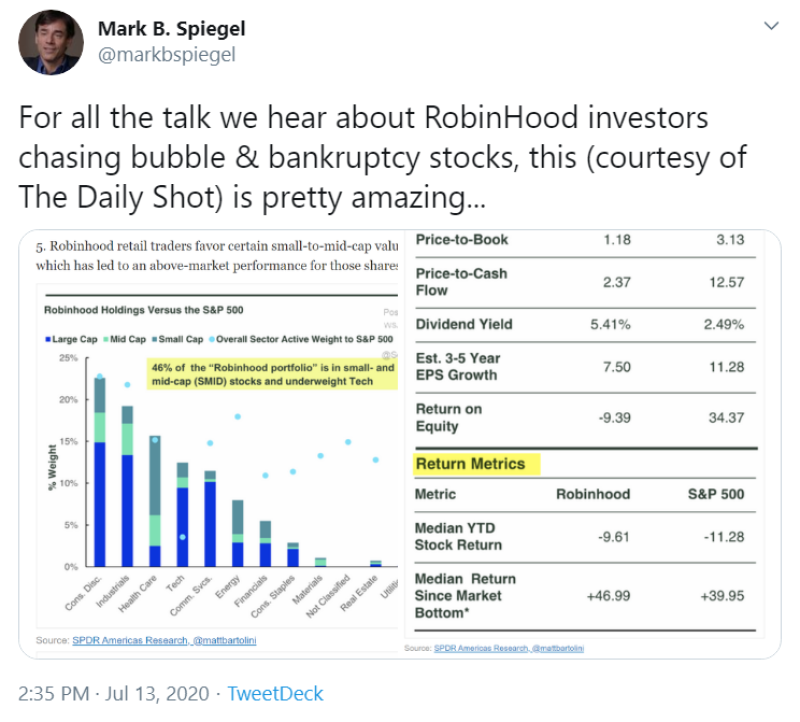

Investors of the Robinhood trading app continue to surprise. Mark B. Spiegel noted that users buy companies with low and medium-capitalization. At the same time, they show better results than the average market.

In their choice, users of the Robinhood app are betting on technology companies that are least likely to appear in news reports.

Investors buying such assets often put a lot of pressure on the shares themselves, which grow faster than the market. Such "Nonames" bring in a large share of the profits.

The average return of investors in the Robinhood app outstrips the return of the S&P 500 index. The median return on investment from the market bottom in March for Robinhood investors is +46.99% while for the S&P 500 index it is +39.95%

Earlier, we published a weekly report, which states that investors choose the best stocks with a good weekly profit.

Usman Salis

Usman Salis

Usman Salis

Usman Salis