Retail Investors Go All-In Using Leverage

Holger Zschaepitz, an author at Die Welt and a market analyst, notes a significant increase in the number of retail investors' deals on the market. They go all-in, using options in order to get more profit from the growth of the market.

“Retail investors going all-in, using leverage to supercharge their stock mkt performance. But explosion in call options drives up volatility as financial leverage works in both directions: UP and DOWN!” Holger Zschaepitz via Twitter

Nevertheless, it is the options market that has a great influence on the volatility of the stock market, therefore, investors, using the option leverage to improve their performance, and accelerate market volatility, which works in both directions, it can both lead to rapid market growth, and no less a precipitous fall.

Robinhood Users Contribute to the Risky Option Trading

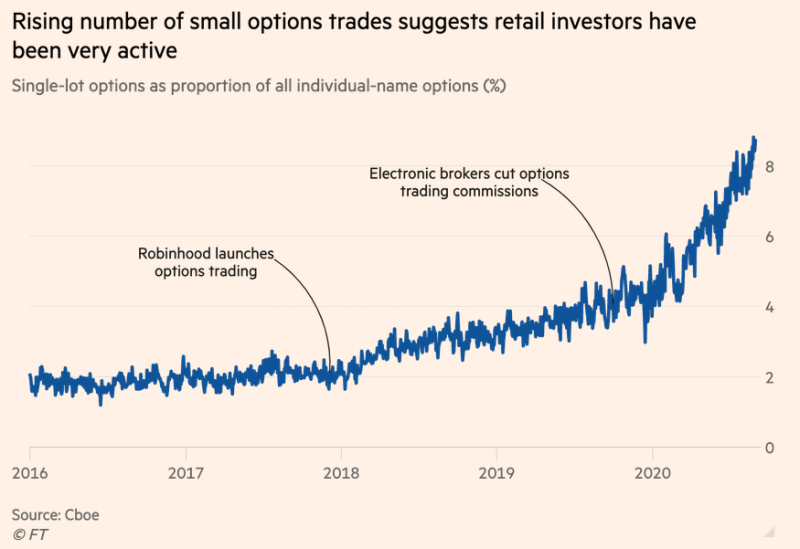

Michael A. Gayed, an analyst and a portfolio risk manager, also notes the trend of rapid demand for options among retail investors. This growth is attributed to the emergence of the opportunity to trade options using the Robinhood application, which is the most popular in its field. After that, large electronic brokers canceled commissions for trading options, which served as an additional trigger for an increase in demand for options:

“Whenever small traders become over-enthusiastic and start trading with leverage, it is usually a warning sign of an impending correction. #stocks #markets #economy #investing #financialservices #retail #optionsmarket #leverage #correction #highrisk” Michael A. Gayed via Twitter

All these factors combined have made changes in the structure of options trading. For the first time, small deals with single-lot options exceeded 8% market share. Mr. Gayed notes that such a significant increase in the number of small traders who are driving the excitement in the options market, who often take risks and trade with leverages, is a sign of an impending market correction.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah