Rayner Teo: A Day Trading Prodigy or a Lucky Man?

It’s not a secret that trading is not equally suitable for everyone: only 20% of those who try it become successful at it. The other 80% surrender in the first year or two and leave the market with nothing. Rayner Teo is the exception from the rule: he has not only managed to stay afloat, but made a living on day trading and developed his strategies. What makes him so special?

Here are some recent facts from his bio:

- In 2020, Rayner Teo was named one of the "Top 10 Most Influential Trading Mentors in Singapore" by the Singapore Business Review.

- He has over 100,000 subscribers on his YouTube channel, where he provides trading education and analysis.

- Rayner Teo recently launched a new product called the "TradingwithRayner Inner Circle," which provides members with exclusive access to his trading strategies and analysis.

- He is also the author of a popular trading book called "The Ultimate Guide to Price Action Trading."

- Rayner Teo regularly speaks at trading conferences and events around the world, sharing his insights and expertise with other traders.

- He is known for his disciplined approach to trading and his emphasis on risk management and position sizing.

- Rayner Teo has a degree in Business Management from Singapore Management University and worked in the finance industry before becoming a full-time trader and educator.

Rayner Teo: a Day Trader, a Blogger, an Influencer

We will start by briefly describing who Rayner Teo is. If you’re not new to the field of trading you’re probably familiar with him being an independent Singaporean trader, who specializes in following market trends and making 4H deals. He describes himself as a ‘swing trader’ because his orders are based on the current market trends. Rayner Teo's YouTube channel counts over 170,000 subscribers, and he also runs the TradingwithRayner website that boasts the audience of over 30,000 traders. Today, he is the most popular Singaporean trader.

Background Info: Rayner Teo Before Day Trading

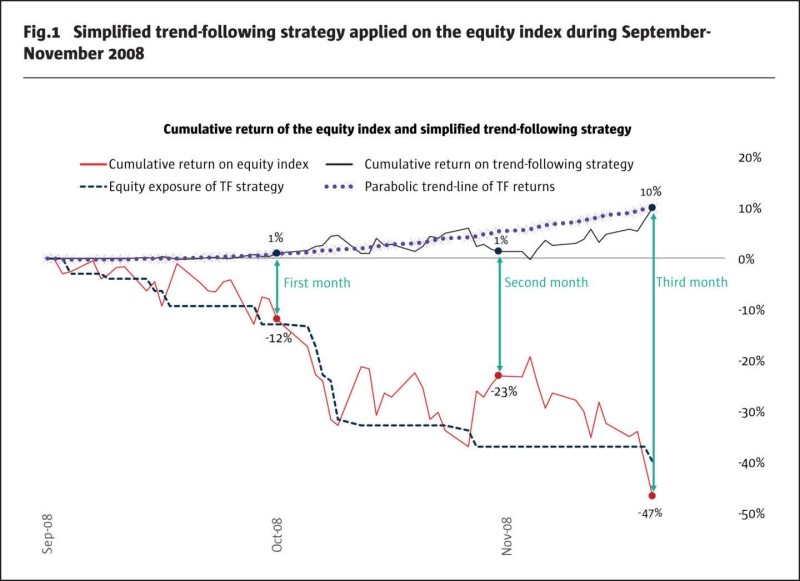

Rayner Teo was born in Singapore, where every guy has to serve in the army for two years. He says that he had enough time to think about his life and what he wants. It was then that the financial crisis of 2008-2009 happened, so the stock market was the talk of the town. He became interested in this topic, started studying financial markets, reading the relevant literature, and finally, graduated from the University of London with a degree in banking and finance.

As Rayner admits, army service taught him discipline, the ability to control emotions, and understand his own self.

During his studies, he participated in a trading competition that was held on a demo account. He lost all the money, but it could be considered his first step in the world of trading. After that, he started to treat trading more seriously.

Rayner did not want to spend half of his life working for somebody. Right from the start, he realized that independent work was more appealing than climbing up career stairs. He knew he needed skills to make a living, and started in a prop trading.

Rayner Teo's Trading Career Path

As a prop trader, he worked in a firm for two years. It helped him gather essential skills and master the basics of trading, but he had to spend hours tracking the market. Of course, it didn't represent the best work-life balance. Feeling that he needed to have more time for his family and personal matters, he started trading on his own.

He had a small starting capital, and it took him four years to become profitable. That was a challenging path. What exactly helped him polish his trading skills?

- Reading of relevant literature, such as articles, news, etc.;

- Rayner Teo's PhD gave him the essential knowledge of the financial sphere and markets;

- Working in a firm as a prop trader;

- Participation in competition with a demo account;

- He tried different strategies to understand what works best for him.

He lost and lost a lot. However, at one point in time, he got the swing of it and started making real money. The success covered his previous losses and made him understand what’s the best trading modality. He still learns. Because trading is a never-ending journey with unexpected twists and turns.

“Deal with the fact that, at first, you will have to invest your time and effort in this business for several years, just to establish the process. Do not expect to turn the deposit of five thousand to a million in six months! The main reason for failure in trading is that people cannot manage their own expectations!”

What Does He do Today?

What Rayner Teo does is called ‘systemic trend trading’. It is very simple: he trades breakouts. This strategy is common among trend traders.

“Perhaps the most important aspect of my trading is that I trade many markets. I trade forex, indices, bonds, soft and hard commodities like metals, and so on. Five sectors with ten markets each!”

Mostly, he specializes in 200-day breakouts. It works the following way:

- Once he notices a breakout, he enters right away by placing a stop loss!.

- If the market moves in the right direction, he starts pulling it up little by little.

- If the breakout turns out to be false, and the market turns around and comes back, he exits on the stop and closes the deal.

Perhaps the key idea behind this method is that we cannot know how far the market will go. Some positions turn out to be real monsters – just look at the growth of the S&P over the past few years. Nobody knows how far the price will go. So all we have to do is just enter on the breakout and then trail our stop.

That’s why Rayner Teo trades in different market sectors – it is impossible to know in advance which one of them will trend. Where there is a trend - we try to ride it. Where there is none, we quickly cut our losses. This is how trend trading works.

Wonder whether Rayner Teo uses any tools to scan and detect market trends, or flips through charts manually? He trades channel breakouts, not the moving average. If the market closes above its maximum level in the last 200 days, this is an entry signal. He tracks markets on a daily timeframe, so it doesn't take much time. He also uses a special tool programmed to place orders.

What About Rayner Teo's Net Worth?

You might be surprised, but Rayner admits not being a millionaire. He has learned to trade for a living, and this is enough to make him happy and fulfilled. Yet, he has serious plans for the future and, who knows, probably he is the next to top of the Forbes list of the most successful traders. He has already established the reputation of a truly successful trader in Singapore. It’s not the money that counts – it’s about skills and knowledge.

What Are his Secrets?

Now when we’re done with the history of his success, let's get down to the most interesting part. Let’s reveal advanced techniques in day trading by Rayner Teo.

While trading, he focuses on such phenomena as Price Action. It is primarily about understanding market movements. Markets are not static, the fluctuation between periods of low and high volatility is a common thing. But it should be noted that volatility and trends are not the same things. There are steady trends with low volatility! So they are completely different things. The period of low volatility never lasts forever. Sooner or later, the volatility starts to grow and the market shoots out. That’s what traders should wait for.

When the market moves in a range for a long time, volatility decreases. Therefore, if there is a sudden sharp movement, the chances are high that the market will continue moving in this direction.

Trend is our Friend

As a trend trader, Rayner Teo admits that not all trends are created equal. Of course, everyone knows that a trend is a series of rising or falling peaks and breakouts. But when you start trading them, you want to be more specific about classifying trends.

He divides them into three categories:

- “I prefer to trade strong trends – this is a sure thing”. A strong trend is when the market is rapidly going up, and pullbacks are shallow, and the price rarely goes beyond MA (20).

- The second type in this classification is the so-called healthy trend. In it, the market forms deeper pullbacks, in which the price reaches approximately MA (50). In a healthy trend, pullbacks are cleaner and more obvious than in a strong trend.

- In case of a weak trend, the market rolls back much deeper, up to MA (100) and MA (200), sometimes even returning to retest levels of previous support or resistance.

Knowledge of the difference between trends might be very useful for traders. Each has its own features. So, it makes sense to research and determine what type of trends you would like to use in your trading. Focus on the option that gives you the best results.

Systematic Approach

Rayner Teo explains that he follows the systemic trend approach as there is no discretion in decision making.

Here’s what he says: “Suppose the channel breaks out on several indices at once: Dow, S&P, Nasdaq ... I will open on all three. The risks have already been taken into account by me in the number of traded instruments. Index sector - 10 stock indices, bond sector - 10 bond markets, forex sector - 10 currencies ... If I receive 30 signals, I will open 30 trades!

During the backtests, I did not take into account correlations and discretion in any way. In my research, I started from bare numbers only! So I need to follow the same approach when trading. Therefore, I do not select any of the most attractive setups for inputs. Everything is traded systematically! This is the method of systematic trend trading. Swing trading is a different matter though.”

Final Words: Tips for Beginners

Can you repeat Rayner Teo’s success? Everything is possible. Here’s what he recommends to beginners.

Having decided on the goal, you can start looking for a suitable strategy. Because if you want to earn a monthly income, then there is no point in choosing trend trading. Unprofitable months and even quarters are common in such a strategy. Trend trading is simply not suitable for achieving this goal, it only works as a long term strategy. However, if you are interested in receiving annual income from your capital, there is no point in scalping every day because the goal of scalping and day trading is to generate profits in a short time. First, define your goal as a trader’s, and find the right strategy to help you achieve the aim.

Do not consider quitting your job right away! As long as you have a job, you get a steady income, so you do not have to rely on trading and consider it the only source of money. In many cases, people are not able to combine day trading or scalping with work, because these methods take much more time than position or swing trading.

What to do in this case? Don't quit your job and learn to trade on four-hour or daily charts. The holding time of the deal should be from several days to several weeks. By trading this way, you don't have to track every market move. You can simply place your stops and targets, and then occasionally glance at your positions throughout the day and accompany them. As a rule, such trading requires much less time from the trader than trading on H1.

Good luck!

Peter Smith

Peter Smith

Peter Smith

Peter Smith