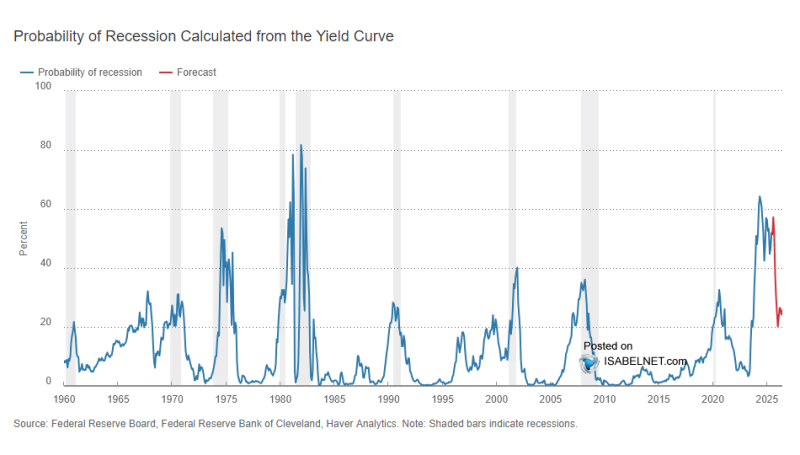

Amid ongoing macroeconomic uncertainty, analysts are once again closely watching the U.S. yield curve—one of the most reliable indicators of a potential recession. According to the latest data from the Federal Reserve Bank of Cleveland, the probability of a U.S. recession within the next 12 months dropped to 25.6% in June 2025. This marks a significant decline compared to previous months, when the figure exceeded 60%.

Recession Probability Declines, but Caution Remains

According to a recent post on Twitter and data from the Federal Reserve Bank of Cleveland, the probability of a U.S. recession within the next 12 months dropped to 25.6% in June. This decline comes after months of heightened risk signaled by the inverted yield curve—a well-known leading indicator of economic downturns.

The chart illustrates that while the probability peaked above 60% in late 2023, the current downtrend marks a notable shift in sentiment. Historically, similar drops in recession probability have followed significant monetary policy adjustments and improving economic metrics.

Yield Curve Insights Point to Soft Landing

As the U.S. economy adjusts to tighter monetary policy and easing inflation, the yield curve forecast (shown in red) now suggests a reduced chance of recession through 2025. However, analysts caution that structural risks, such as consumer debt and commercial real estate stress, remain relevant.

The Federal Reserve has not ruled out future rate hikes, but the yield curve data—closely followed by bond market participants—hints at a possible soft landing rather than a severe economic pullback.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah