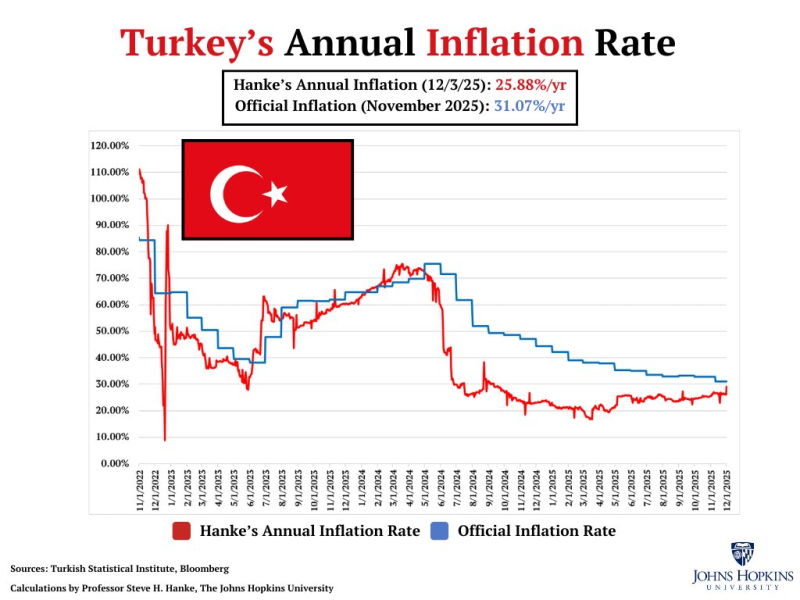

⬤ Turkey's inflation rate keeps easing - the official figure reached 31 % in November, down from 33 % the previous month. Independent observers place the true yearly rate nearer 26 %. Those unofficial series have long foretold the path of the published data. For multiple months both series have fallen together, a sign that the long spell of runaway price rises is finally easing.

⬤ During 2022 and early 2023 inflation was unchecked - the official index topped 70 % and the independent gauges were only slightly lower. From mid-2023 onward the trend reversed. Month after month through 2024 and into 2025 the official rate slid to the low 30s while the private index settled in the mid-20s. The gap between the two keeps narrowing, which indicates that the improvement is not a statistical artefact.

My model leads the official rate, the independent tracker says. I expect the published figure to keep falling in the next few months.

⬤ Turkey's inflation remains high when set against advanced economies - yet the direction is decisive. When the rate vaulted above 70 %, firms could not set budgets and households saw their buying power evaporate. Now that both indices fall in step, the worst appears to be past. The question is whether the descent will continue or stop in the high 20s.

⬤ The issue reaches beyond the figures, because inflation drives currency stability and interest-rate choices. A sustained fall could recalibrate investors’ view of Turkish risk and shape whether the central bank keeps its present course. With both indices pointing to further relief, the coming months will show whether Turkey has escaped its inflation trap or merely enjoys a lull.

Peter Smith

Peter Smith

Peter Smith

Peter Smith