The world's investment landscape has transformed dramatically over the past 75 years. Today's global portfolio heavily favors stocks and bonds, relegating gold to a minor role.

What the Numbers Really Show

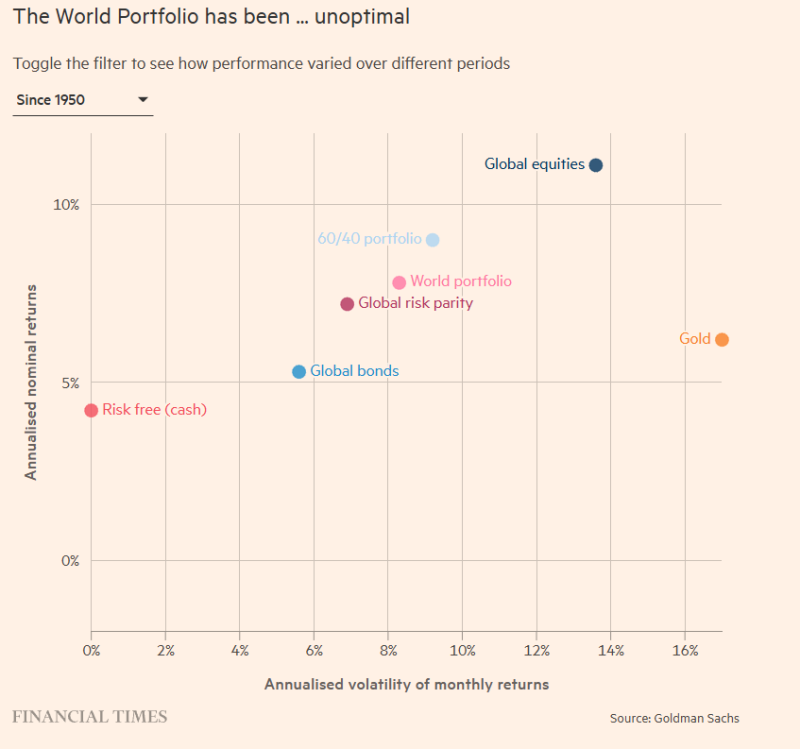

But recent analysis from Wall St Engine and Goldman Sachs' historical data tells an interesting story: the so-called "world portfolio" hasn't actually been optimal. While equities deliver strong returns with higher volatility and bonds offer stability with modest yields, gold—despite its own volatility—plays a unique role that numbers alone don't fully capture.

Goldman Sachs plotted annualized returns against volatility going back to 1950, and the patterns are revealing. Global equities delivered the highest long-term gains—over 10% annually—but came with substantial volatility around 12%. Bonds played it safer with roughly 6% volatility but returned only about 5%. Gold presented an interesting middle ground: higher volatility at 15-16%, yet consistent returns in the 6-7% range, confirming its reputation as a crisis hedge.

The classic 60/40 portfolio (60% stocks, 40% bonds) actually outperformed the world portfolio on a risk-adjusted basis. Meanwhile, the world portfolio itself managed about 7.8% annualized returns (4% real) since 1950 but fell short due to its heavy tilt toward bonds. Risk parity strategies, which balance volatility across asset classes, demonstrated that smart diversification beyond just stocks and bonds improves portfolio efficiency. The data backs up the core message: the world portfolio's structure has been less than ideal.

Why Gold's Small Allocation Matters More Than You'd Think

Gold has consistently proven its worth during the times that matter most. It surged during the 1970s inflation shock and has repeatedly provided defensive value when geopolitics or financial markets turned turbulent. Even at small portfolio weights, gold reduces overall drawdowns and adds meaningful diversification. With government debt levels climbing and central banks navigating uncertain monetary territory, gold's stabilizing role carries more weight than its 3% allocation might suggest.

Usman Salis

Usman Salis

Usman Salis

Usman Salis