The euro-dollar pair kicked off October on a strong note, bouncing sharply from recent lows and catching the attention of technical traders. After weeks of getting hammered by dollar strength, EUR/USD finally found its footing and is now testing whether this rally has legs.

The Technical Picture

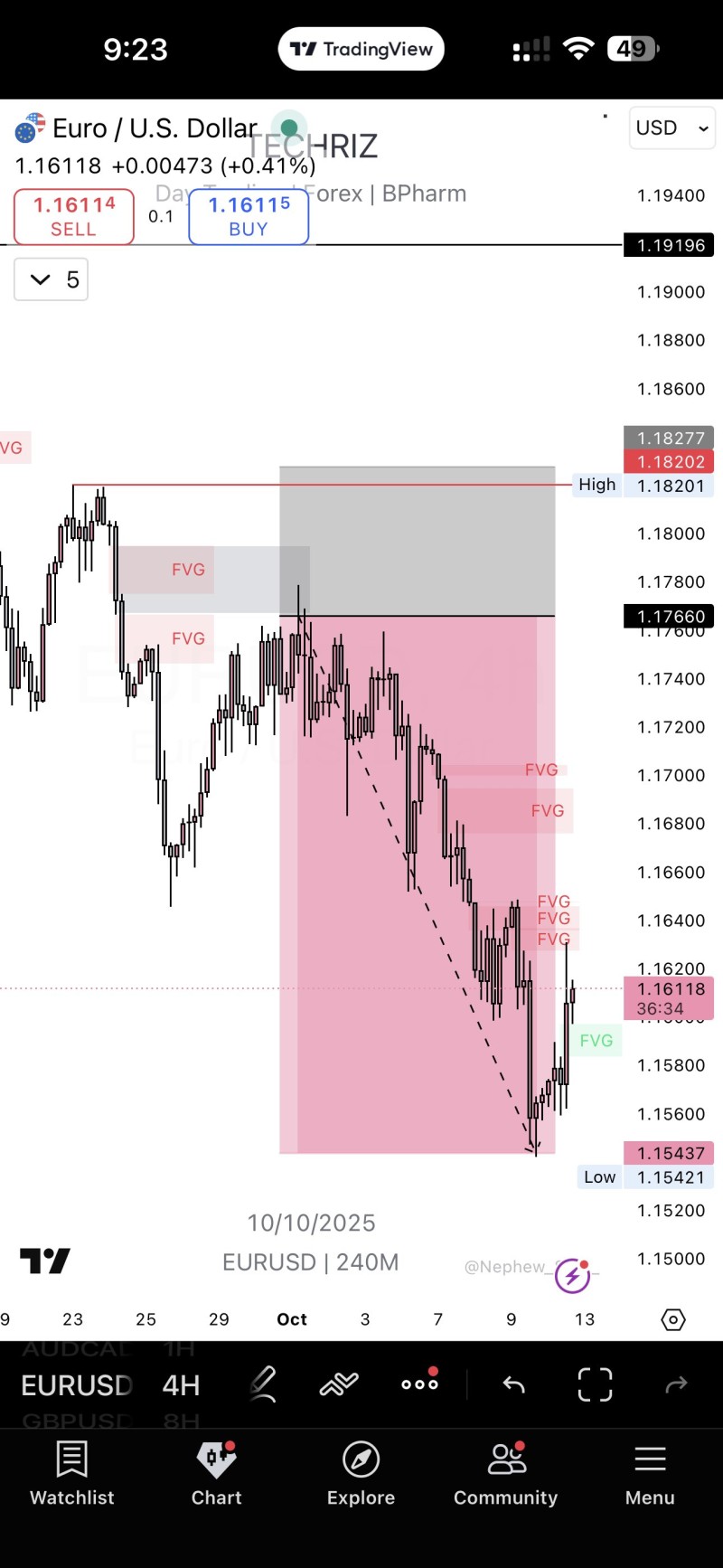

Trader Techriz recently highlighted the pair's clean start to the month, noting it's tracking a promising 3R swing setup with "zero drawdown" so far. That's the kind of setup swing traders dream about—minimal pain, maximum potential.

Looking at the charts, EUR/USD bounced hard from the 1.1540–1.1545 zone, which basically became a launching pad after sellers exhausted themselves. The pair has since climbed toward 1.1760–1.1820, a messy resistance area packed with fair value gaps and old supply zones.

Here's what matters: 1.1540 is holding as the floor. Lose that, and we're probably heading down to 1.1400. On the flip side, if EUR/USD can punch through 1.1820 and actually stay there, the door opens to 1.1900 and possibly even 1.2000. The multiple fair value gaps scattered along the way up are acting like speed bumps—pockets of old selling pressure that could slow the rally.

What's Driving This Move

The dollar's been catching its breath after a relentless run higher fueled by sticky Treasury yields and hawkish Fed talk. Meanwhile, traders are keeping one eye on the ECB. Any hint that European policymakers are getting soft on rates could cap how far the euro can run.

Right now, EUR/USD looks like it's bouncing within what's probably still a bigger downtrend. As long as it stays above 1.1540, the bulls have something to work with, and that 3R setup stays in play. But if that support cracks, the whole bullish story falls apart, and we're back to watching for lower lows.

Peter Smith

Peter Smith

Peter Smith

Peter Smith