The euro currency pair retreated from yearly highs around 1.1570 as the US Dollar Index (DXY) recovered from three-year lows below 98.00, but technical indicators continue to suggest a bullish outlook for EUR/USD.

EUR/USD Faces Tariff-Driven Volatility

The EUR/USD pair has lost momentum after failing to surpass Monday's yearly peak near 1.1570, allowing sellers to drive the pair lower as the US Dollar Index (DXY) staged a significant comeback from recent three-year lows in the sub-98.00 territory.

President Trump's latest tariff announcement has maintained pressure on risk sentiment across markets. The proposal includes a blanket 10% duty on all trading partners, supplemented by surcharges up to 50% for certain regions and a substantial 145% levy on select Chinese goods. The announcement of a 90-day reprieve for non-retaliating nations and the exclusion of smartphones and computers from the tariff list provided only brief relief to concerned markets.

European Union officials have made it clear that Brussels stands ready to implement countermeasures if necessary, potentially escalating trade tensions further. Tuesday's notable recovery in the Greenback was primarily driven by encouraging statements from US Treasury Secretary Bessent, which offered temporary relief regarding the US-China trade conflict.

The Federal Reserve maintained its policy rate at 4.25%–4.50 % this week, with Chair Jerome Powell emphasizing that combating inflation remains the primary objective, even as new tariffs threaten to create stagflationary conditions in the economy.

In his recent communications, Powell stressed that future rate adjustments will depend on evolving inflation and growth trends. He also warned that rising import duties could place the Fed in the difficult position of balancing conflicting economic objectives.

Meanwhile, the European Central Bank (ECB) delivered its widely anticipated 25 basis point cut, bringing rates to 2.25%. The ECB also removed the term "restrictive" from its policy statement and signaled a data-driven approach to future decisions. These changes have prompted market participants to price in another rate reduction at the June meeting, potentially widening the interest rate differential with the United States.

EUR/USD Influenced by Trump's Fed Criticism

The US Dollar managed to reverse some of its recent bearish momentum as President Trump intensified his criticism of Federal Reserve Chair Jerome Powell, describing him as "a major loser" for not implementing interest rate cuts. In a social media post, Trump urged Powell to lower rates "pre-emptively" to support economic growth, accusing the Fed chair of responding too slowly to changing economic conditions.

This renewed criticism emerged amid growing market turbulence connected to Trump's own tariff policies, which have unsettled investors and fueled concerns about potential stagflation. The timing of these comments suggests an opening of another front in the administration's economic policy approach, with potential implications for dollar strength and EUR/USD dynamics.

EUR/USD Positioning and Technical Analysis

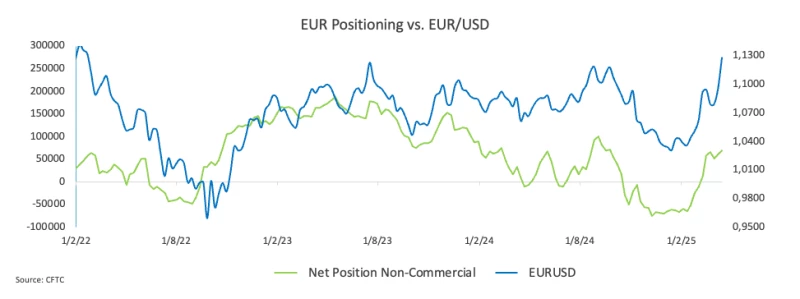

Speculative positioning data reveals that net long positions in the Euro climbed to approximately 69,300 contracts in the week ending April 15, reaching their highest level since September 2024. Commercial traders, meanwhile, increased their net short positions to nearly 118,000 contracts, also marking multi-month highs. Open interest surged past 708,000 contracts, a five-week peak, indicating strong market participation and conviction.

From a technical perspective, the 2025 high at 1.1572 (established on April 21) represents the first significant resistance level for EUR/USD, followed by the October 2021 high at 1.1692 (recorded on October 28). Initial support can be found at the 200-day simple moving average (SMA) at 1.0762, with additional support at the weekly low of 1.0732 (reached on March 27).

Momentum indicators continue to present a bullish picture despite recent price action. The Relative Strength Index (RSI) has eased just below the 70 threshold, while the Average Directional Index (ADX) remains elevated above 51, suggesting that the broader upward trend remains intact and robust.

EUR/USD Market Outlook

With the US Dollar showing renewed strength and tariff-related headlines continuing to dominate market narratives, EUR/USD appears set for continued volatility in the near term. Each new policy signal from the Federal Reserve or European Central Bank, along with developments in the trade policy landscape, will likely trigger rapid price movements in the currency pair.

This environment of elevated volatility is expected to persist until greater clarity emerges regarding both monetary policy trajectories and the ultimate implementation of proposed trade barriers. Despite these uncertainties, technical indicators continue to suggest that EUR/USD remains in a generally bullish posture, with potential for additional advances once current headwinds diminish.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah