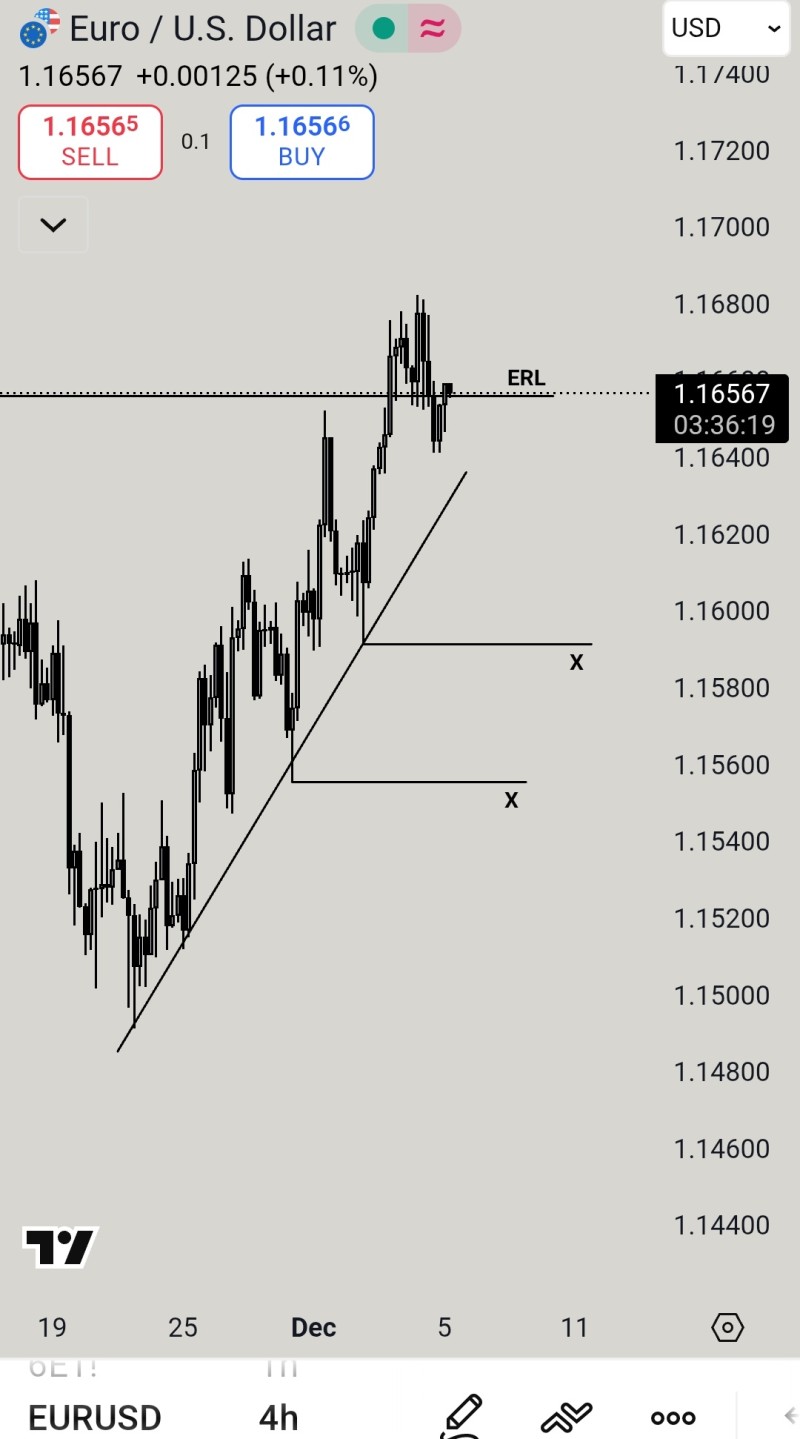

⬤ EUR/USD is trading around 1.165, holding just below minor resistance shown on the chart. The pair looks ready to dip toward liquidity sitting beneath the ascending trendline that's been supporting the recent rally. Current candles show hesitation after the extended climb, with the ERL marker highlighting where price is stalling right now.

⬤ The chart reveals EUR/USD building higher lows, but momentum is fading as the pair struggles to break past the latest swing high. Below the trendline, liquidity zones near 1.159 and 1.156 line up with earlier consolidation areas where price gathered steam before pushing higher. These levels are natural targets if EUR/USD pulls back toward the diagonal support holding the structure together.

⬤ If the pair keeps stalling under the ERL level, a move toward the trendline seems likely as traders test those liquidity pockets. The uptrend is still holding, but the lack of follow-through hints at a potential correction while the market figures out its next move. Those clean liquidity zones below the trendline are where things could get interesting once price taps into them.

⬤ This setup matters because EUR/USD often signals broader shifts in currency sentiment. A drop toward lower liquidity areas might show momentum cooling across major forex pairs as traders position ahead of key economic data releases.

Usman Salis

Usman Salis

Usman Salis

Usman Salis