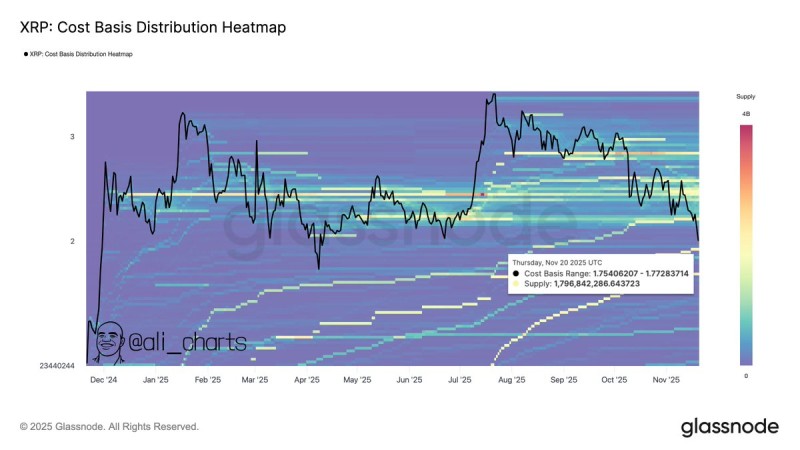

⬤ Nearly 1.80 billion XRP were previously bought around the $1.75 cost basis range, creating one of the largest support concentrations visible on the latest Glassnode Cost Basis Distribution Heatmap. The chart shows XRP's price dropping toward this dense cluster, meaning the asset is once again testing a zone where a huge chunk of holders originally entered their positions.

⬤ The heatmap shows how the $1.75 to $1.77 band contains roughly 1.796 billion XRP, making it one of the most significant accumulation areas of 2025. Price action indicates that XRP has repeatedly bounced around this same territory throughout the year. After multiple attempts to push higher above $3.00 between July and October, the asset has now slipped back toward the mid-$1 range, lining up almost perfectly with this heavy cost basis cluster.

⬤ This dense accumulation zone represents a major psychological and technical anchor for the market. The chart reveals earlier surges into the $2.00 to $3.00 levels where distribution phases were more visible, followed by a return to the stronger support structure. The presence of nearly 1.80 billion XRP acquired at these levels means a large share of supply remains sensitive to price moves around the mid-$1 region. If current selling pressure continues, this cluster may determine whether XRP stabilizes or extends its recent decline.

⬤ What makes this pattern important is how tightly concentrated supply is within the cost basis shown on the Glassnode heatmap. High-density areas often act as stabilization points during market pullbacks. A solid hold above this support could help calm volatility, while a breakdown below this zone might shift sentiment across the broader crypto market given XRP's large market cap and historical role as a high-liquidity asset.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah