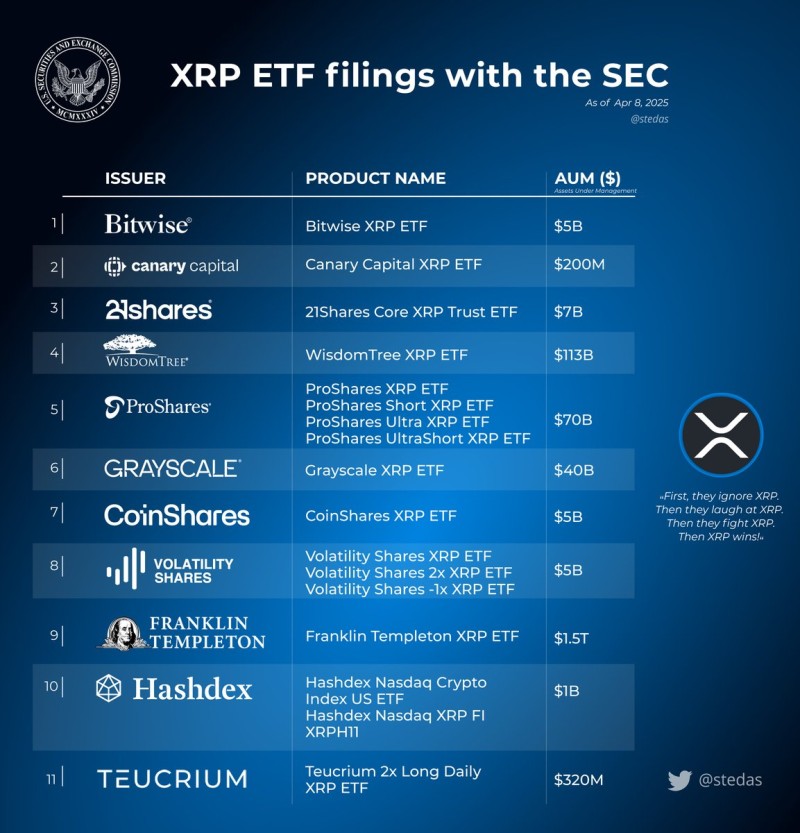

As the cryptocurrency market eyes a new phase of institutional acceptance, XRP is emerging as a frontrunner. Recent data reveals that 11 XRP-focused exchange-traded fund (ETF) filings have been submitted to the U.S. SEC, signaling massive institutional interest. With billions in assets under management (AUM) behind them, these filings could significantly influence XRP’s price trajectory.

WisdomTree Leads XRP ETF Filings with $113B AUM

According to the chart, the most prominent filing comes from WisdomTree, which submitted an XRP ETF backed by $113 billion in AUM. This dwarfs other major contenders like 21Shares ($7B) and Grayscale ($40B), underlining the scale of confidence in XRP’s future.

Other key participants include:

- Bitwise XRP ETF – $5B AUM

- CoinShares XRP ETF – $5B AUM

- Franklin Templeton XRP ETF – $1.5T in broader fund support

- ProShares XRP suite (including long and short strategies) – $70B AUM

- Hashdex XRP FI ETF – $1B AUM

- Teucrium 2x Long Daily XRP ETF – $320M AUM

These filings span both traditional and leveraged ETF products, hinting at a diverse range of investor strategies being planned around XRP.

Institutional Interest Could Lift XRP Price Further

With XRP currently trading around $3.17, the wave of ETF filings adds optimism to bullish forecasts. Institutional access through regulated ETFs could greatly expand demand, reinforcing XRP’s long-term utility and price support.

As multiple firms compete to launch the first SEC-approved XRP ETF, this surge in filings might signal the beginning of a broader shift in how traditional finance engages with XRP.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah