XRP experiences a sharp rise in whale transactions and bullish sentiment, sparking concerns over potential market correction risks.

XRP Sees Sharp Rise in Whale Transactions and Bullish Sentiment

In the past few hours, XRP has caught the eye due to unusual activity from institutional investors and a significant uptick in bullish sentiment. According to recent data, the number of major transactions involving XRP has nearly doubled within a day, signaling renewed interest in this cryptocurrency.

Large volume transactions, often referred to as 'whales,' have seen an unprecedented increase for Ripple’s crypto. Data from Santiment reveals that the number of these transactions of at least $100,000 surged by 92% within 24 hours, jumping from 332 to 637 transactions per day. This notable rise indicates growing investor optimism towards XRP, which is further confirmed by a 65% increase in positive perception during the same period.

Investors began accumulating XRP on July 2, when the cryptocurrency's price was around $0.478. This accumulation phase appears to be concluding, accompanied by increased activity on exchange platforms. The number of tokens entering exchanges climbed from 55.1 million to 92.9 million, while those exiting rose from 25.3 million to 69.7 million. This net difference of 23.2 million tokens suggests a higher prevalence of short-term profit-seeking investors compared to those continuing to accumulate the asset.

XRP Faces Key Resistance Levels

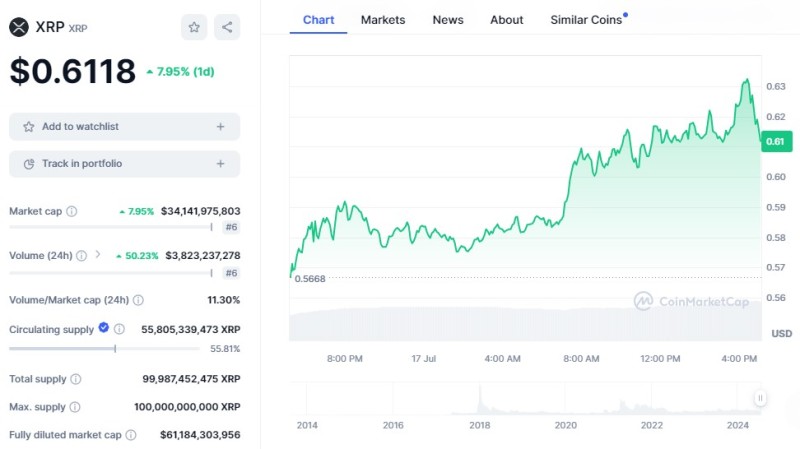

Moreover, XRP's relative strength index (RSI) is currently around 67, indicating that the asset is slightly overbought, which could signal a potential price correction. Currently, XRP is up 7.95% over the last 24 hours, trading at $0.6118. With a market capitalization exceeding $34 billion and a daily trading volume of $3.5 billion, XRP briefly hit a three-month high of $0.6176 earlier today.

In terms of technical indicators, XRP’s hourly MACD is now in bullish territory, confirming the positive momentum. These technical indicators, combined with the recent increase in whale activity, suggest substantial upside potential provided key resistance levels are surpassed. The current market dynamic is being fueled by rising price expectations among investors.

In conclusion, despite the bullish outlook, the risks of a market correction remain significant. The market's evolution in the coming days will be crucial in determining whether XRP can sustain this upward trajectory or if it will face a pullback. Investors and traders will need to closely monitor these developments to navigate the potential volatility in XRP's price movement.

Peter Smith

Peter Smith

Peter Smith

Peter Smith