Ripple (XRP) is showing signs of a looming correction, with its failure to breach a crucial resistance level amidst a backdrop of negative sentiment in the market.

Ripple (XRP) Price Analysis

The daily chart for Ripple (XRP) hints at a looming correction as the altcoin struggles to surpass a critical resistance level. The absence of positive news and growing bearish sentiment in the broader market are compelling investors to offload their holdings, potentially exacerbating the downturn.

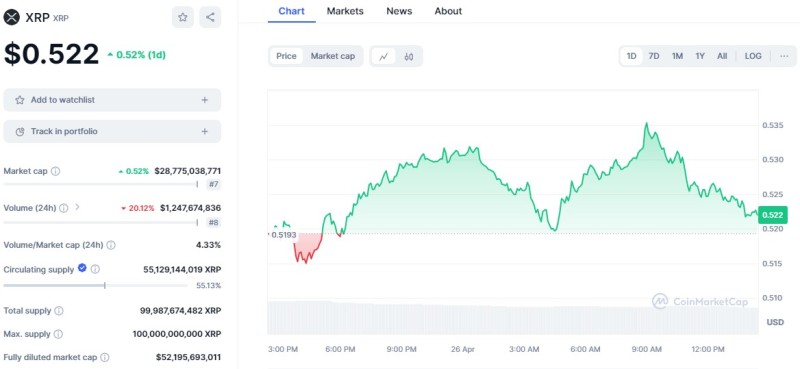

The drop in Ripple's price to $0.52 has triggered a wave of pessimism among investors, evident in the divergence chart of daily active addresses (DAA), which now signals a sell-off. Moreover, the number of new XRP addresses has plummeted to a four-year low, indicating a decline in investor support that could lead to further price declines.

Price Outlook and Key Levels

Currently trading at $0.52, XRP rests on the 23.6% Fibonacci retracement level between $0.73 and $0.42. Maintaining above this level is crucial for potential recovery. However, if bearish sentiment persists, Ripple might breach crucial support levels, potentially dropping to $0.47 and further to $0.42. A successful bounce, however, could propel XRP to the 38.2% Fibonacci line at $0.57, possibly leading to a recovery towards $0.60.

In conclusion, Ripple (XRP) stands at a critical juncture, with indicators suggesting a significant correction. Investor sentiment plays a pivotal role in determining the altcoin's trajectory, with the need to maintain crucial support levels to avert further downturns and pave the way for potential recovery.

Usman Salis

Usman Salis

Usman Salis

Usman Salis