Trading cryptocurrency has become a fad over the last few years and is now a relatively good means of earning for both professional traders and enthusiasts. If we look at the price charts that have been compiled over the years by a variety of channels, we can see that the crypto market is exhibiting market dynamics and fluctuations much like those found on traditional markets. This makes it clear that the presence of volatility on the crypto market makes it a profitable area for trading.

Of course, the main question that arises in the minds of most aspiring crypto traders is how to make money trading cryptocurrency. For this reason, many seek to learn how to day trade cryptocurrency. Anyone willing to make the effort can truly find opportunities here. For instance, the exchange rate of BTC has grown from about $800 in 2013 to over $5,000 in 2019, after spiking to over $20,000 in 2017. Ethereum was just as remarkable in its dynamics, having gone from $0.57 in 2014 to $1,180 in 2017 to $171 in 2019. Ripple was similar, going from $0.02 in 2014 to $0.32 in 2019. If that isn’t volatility, we don’t know what is. This makes the crypto market one of the best avenues for risky traders seeking to make a fortune. But mastering how to make a fortune is more than half the battle.

How to Start Trading Cryptocurrency

Anyone who wants to sink their teeth into the juicy cake of crypto trading has to first understand where crypto is traded. Like every other financial instrument put up for trading, cryptocurrency is placed on exchanges. The crypto market hosts over 200 exchanges, some more reputable than others. Among the best and most renowned are Binance, Bittrex, Huobi, Coinbase, Xena Exchange, and many others.

Unlike traditional exchanges on Wall Street, crypto exchanges are divided into two types – centralized and decentralized. Both operate on blockchain technology and provide almost the same level of convenience, depending on the instruments offered and the architecture of the user interface. However, some exchanges are decentralized, meaning that they do not store any user information, including wallets, on any of their servers or systems, resorting to external services in this regard. Decentralized exchanges do not require any intermediaries to conduct operations and perform all the order matching themselves.

On the other hand, centralized exchanges resort to a number of intermediary services to conduct their operations. The intermediaries provide everything from order matching to user wallet storage. This makes centralized exchanges much riskier and more expensive compared to their decentralized counterparts.

Despite the obvious differences in platform structure, there is also the issue of convenience. Most decentralized exchanges have horrible user interfaces and are much more difficult to master, and when it comes to speed, centralized exchanges win over their decentralized counterparts, since their platforms are better suited for transactions. Though there are tendencies of reversing the issue, the situation still remains in favor of centralized exchanges.

Centralized exchanges also win over decentralized ones in another important factor vital for trading – liquidity. Decentralized exchanges cannot compete with centralized ones in trading volume. However, decentralized exchanges win in terms of an almost complete lack of commissions and higher security, since they do not rely on any intermediaries.

When dealing with crypto exchanges, traders also need to know how crypto trading bots work because bots are allowed on crypto exchanges and facilitate trading considerably. When resorting to bots, it is important to first analyze the available exchanges and understand which ones offer the best instruments for convenient trading.

Given the many restrictions placed on cryptocurrency trading in some countries, many traders might ask how to trade cryptocurrency in the US. The issue is not as complicated as it might seem, since most reputable exchanges, like Binance and others, operate legally on the US market. It is therefore necessary for traders to research their platforms of choice before using them to make sure they comply with the laws of the United States.

How to Choose a Cryptocurrency Exchange

When selecting a cryptocurrency exchange for trading, users must first analyze all the features of the exchanges they have set their eyes on. It is quite a tricky and highly personal matter, since more experienced traders prefer more complex platforms that offer greater functionality, while novice traders want to hone their skills on less complicated platforms.

Xena Exchange is rightfully one of the most convenient exchanges, featuring a broad range of functionality and a number of important advantages. First and foremost, Xena Exchange has a highly convenient and user-friendly interface that is uncluttered and allows users to see all the vital information on one screen with hotkey options for even faster trading. Second, Xena Exchange has zero commissions on spot orders. In addition, the exchange offers a wide variety of orders, such as stop orders and limit orders, and products, such as the Market Barometer, which boasts over 30 indicators. The variety of orders on Xena Exchange make it a convenient platform for a wide range of strategies. The highest level of security is provided, partially through the use of decentralized accounts that safely store all user information off-site, making it immune to external interference.

Don’t delay your start on the crypto market: Register on Xena Exchange right now by following this LINK and filling out the easy step-by-step process.

How to Trade Cryptocurrency

Trading cryptocurrency is done almost exactly the same way as with other financial instruments – through the application of a variety of strategies. The main strategies on the crypto market are much like those on other markets, such as Forex, and they include:

Scalping – launching a very large number of small orders to make small profits in bulk rather than waiting for one large win.

Intraday – placing orders during trading hours and buying and selling assets, fixing profits within a single day without risking off-hour volatility.

Investing (long- and short-term) – waiting for an asset’s price to move (preferably up) and fixing the resulting profits.

Intraday trading compared to week-term investing

5 min

1D

There are dozens of trading strategies on the market, and Xena Exchange allows its users to make use of most of them through its convenient interface. Learn more about the types of strategies HERE.

How to Trade Bitcoin

Bitcoin is the most coveted coin out there, with its volatility being its main allure and bane. The first and main question posed by any starting trader is how to trade Bitcoin for profit. In fact, this question is often associated with becoming a Bitcoin trader, which in itself constitutes a rather distorted view of the crypto market, since the latter encompasses much more than Bitcoin alone. The issue of how Bitcoin trading works is largely a reflection of any trading process on the market and does not involve any special circumstances apart from the asset’s volatility.

Trading Bitcoin is done exactly the same way as with any other crypto asset, but when trading BTC, the question of how to automate Bitcoin trading also arises. This is where traders must first realize that their exchange and strategy of choice are the determining factors in automation and the use of bots.

How to Trade Bitcoin Cash

This question is raised in parallel to the one above,and the answer is the same. All coins are traded on exchanges, and the only differences are in the instruments being used and the platforms they are based on. Bitcoin Cash is a widely popular asset and can be found on virtually every exchange that has a name. As such, traders must choose the assets they wish to trade before embarking on their trading journeys.

How to Trade Ethereum

Ethereum is the second-most popular name on the market, second only to Bitcoin, and is traded in exactly the same way. Ethereum is considered a less risky asset, since its price is low and it is far more commonly encountered than its more expensive counterpart.

How to Trade Ripple

Ripple is the third-most frequently encountered name on most crypto asset charts, mostly because of its relatively low volatility and popularity as a transaction instrument for some banks. The confidence that traders have in Ripple and its low price makes it a favorite for beginning traders and a low-cost option for scalping orders.

Learning How to Trade Cryptocurrency

The biggest challenge facing any aspiring trader who wishes to join the crypto market and start trading Bitcoin and other assets is learning how to do it properly. In fact, reading is the only way, followed by a gradual and phased transition from test trading to real trading. The process may well be painful at first, but experience counts the most in trading.

Xena Exchange knows all too well how difficult it may be to learn the ropes of crypto trading, so the platform is delighted to present an entire block of content devoted exclusively to educational content.

The https://medium.com/xena-exchange/basics/home section offers accessible, clear, and valuable insight into the steps necessary to start your journey into crypto trading.

In addition to an educational section, Xena Exchange has integrated its new Market Barometer into its trading interface. The Market Barometer is an invaluable tool that facilitates trading by offering a comprehensive and all-encompassing analysis of the market, allowing traders to both see the broader picture and delve into the details of specific assets. Transactions, volatility, money flows, and much more are presented on the instrument panel of the Market Barometer, which grants users full insight into the market for more effective and efficient trading.

Risks

Crypto trading is not without its risks. The market is inherently risky due to a number of factors. Ironically, the profit-making factor of volatility is can also reduce profits to losses. When embarking on the journey of crypto trading, aspiring traders must realize and ascertain the risks involved and consciously undertake all subsequent steps.

The best step to take is to create a trading strategy first and rely on one of the most important instruments available on the market – the margin. By trading with a margin, traders can minimize their losses and ensure a large enough trading volume. Xena Exchange offers a large variety of margins, from x1 to x20, to ensure that traders have the necessary leverage to trade effectively.

It is important to note that margin trading is an advanced instrument and is not reliable enough for novice traders. As such, Xena Exchange encourages aspiring traders to refrain from margin trading until they are confident enough to risk greater volumes of assets during trading.

How to Minimize Trading Losses

Minimizing trading losses is one of the main aspects of trading. The most important instrument that comes into play in this case is risk management. There are many types of risk management techniques, but all of them boil down to using the necessary instruments for minimizing losses. Some of the instruments most often used for risk management are the following.

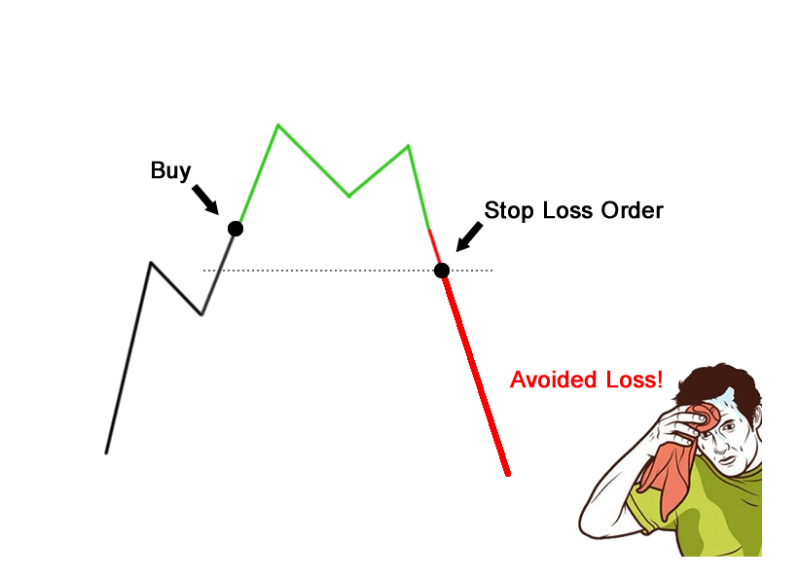

Stop-loss orders are placed with a limit to sell a security when it reaches a certain price. Stop-loss orders are designed to limit an investor’s loss on a position with an asset.

Take-profit orders are a type of limit order that specifies the exact price at which to close out an open position for profit.

Apart from orders and instruments, everything boils down to the trader’s own character. Dealing with emotions and maintaining your composure when trading is key. Applying a disciplined approach that keeps the trader away from panic ensures calm emotions and keeps the trader focused on making profits and seeing the bigger picture rather than fixating on the target. A systematic approach involving the creation of a trading strategy is the first and most important step that keeps trading both safe and versatile enough to keep traders from spiraling into losses at the first sign of downturns.

Keep It Going

Learning is a process of acquiring experience, which counts the most in trading. Before embarking on trading cryptocurrency, traders must first compile a large enough amount of knowledge to rely on in the variety of situations that can arise on the market. First and foremost, it is vital to refrain from negative sentiment and look ahead into brighter prospects. Second, aspiring traders must study the market and find a suitable platform. Third, novice traders must build a strategy that suits their character and style and make sure to abide by it. Once they have mastered all that, they can start delving into the more advanced aspects of trading.

Whatever path traders decide to take, Xena Exchange will be there to help them, offering both information and instruments to make sure their trading is profitable and enjoyable.

Michael Budkov

Michael Budkov

Michael Budkov

Michael Budkov