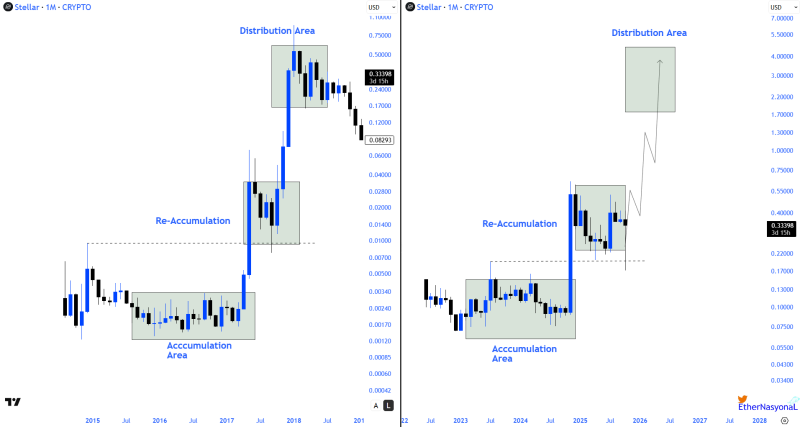

History might be repeating itself for Stellar (XLM). A recent analysis by reveals striking parallels between XLM's current market behavior and its 2017 cycle—a setup that preceded one of the project's most explosive rallies. The latest monthly chart comparison shows Stellar has wrapped up its deep accumulation and re-accumulation phases, hinting that the stage may now be set for a fresh parabolic expansion.

Chart Analysis: A Mirror of 2017's Wyckoff Formation

The side-by-side comparison of two monthly charts—2015–2018 on the left and 2022–2026 on the right—shows an almost identical Wyckoff-style progression. In 2016, XLM spent months consolidating in a low-volatility range before breaking out. The same pattern emerged in 2023–2024. After the initial breakout, Stellar entered a secondary accumulation zone where smart money typically reloads before the next leg up. In 2017, this sequence pushed XLM from fractions of a cent to above $0.75. The current projection points to a similar expansion, with a potential distribution zone near $3–$4.

Right now, XLM is trading around $0.33, consolidating just above the re-accumulation area—suggesting the market structure remains intact for another possible surge.

Technical Outlook: The Three-Phase Cycle

According to EtherNasyonaL, XLM's setup follows the classic Wyckoff cycle:

- Accumulation Phase – Smart money quietly builds positions while price stays flat

- Re-accumulation Phase – Price consolidates again after a smaller rally, shaking out weak hands

- Parabolic Expansion – The breakout phase where price accelerates rapidly

This repeating structure points to building bullish pressure beneath the surface. As long as XLM stays above $0.22, the momentum looks solid, with the next major resistance around $0.55. A clean break above that level could spark a renewed long-term rally.

Beyond the charts, Stellar's fundamentals back up the bullish case. The network keeps expanding its cross-border payment ecosystem and advancing partnerships for tokenized assets and on-chain settlements. If the broader crypto market maintains its risk-on mood heading into 2025, XLM could benefit from both technical and fundamental catalysts lining up at the same time.

Conclusion: The parallels between 2017 and 2025 suggest Stellar might once again be on the verge of a major bullish cycle. With accumulation and re-accumulation wrapped up, and price structure echoing the early stages of its previous rally, XLM looks technically ready for parabolic expansion.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah