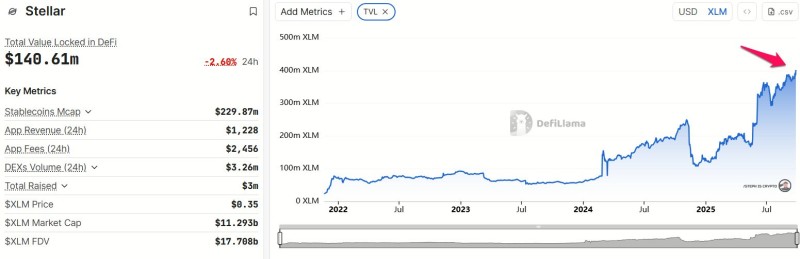

Something's been brewing on Stellar that most people missed. The network's total value locked just crossed 400M XLM, marking the highest point in its history. Data from DeFiLlama shows the surge started gaining steam in mid-2024 and hasn't let up since.

What's Actually Driving This

Market observer STEPH IS CRYPTO flagged the move, noting TVL has literally doubled in recent months. This isn't just number-pumping - it's real liquidity flowing into Stellar-based protocols.

The growth isn't coming from one place. Stellar's stablecoin market cap now sits at $229.8M, cementing its reputation as a solid payments rail. DEX volume hit $3.26M in the last 24 hours alone, while protocol fees and revenues keep climbing. Beyond raw numbers, partnerships with financial institutions and cross-border payment integrations are pulling new users into the ecosystem at a steady clip. It's not flashy, but it's consistent.

The Numbers That Matter

Here's where Stellar stands right now. TVL in USD terms is $140.61M, down 2.6% in 24 hours but still near all-time highs. XLM trades at $0.35 with an $11.29B market cap and $17.70B fully diluted valuation. The project raised just $3M total, which makes this level of traction pretty remarkable. These aren't vanity metrics - they're tied to actual DeFi activity and stablecoin movement, not just speculation.

XLM sitting at $0.35 feels almost disconnected from what's happening on-chain. Usually, rising TVL leads to price strength as tokens get locked up in liquidity pools and lending protocols. If Stellar keeps this pace, demand for on-chain collateral could finally catch up. But competition from Ethereum, Solana, and Avalanche is fierce, and the whole stablecoin regulatory situation could make or break this narrative long-term.

Peter Smith

Peter Smith

Peter Smith

Peter Smith