Anatoly Yakovenko weighs in on the potential inclusion of Solana (SOL) and other cryptocurrencies in the US government's strategic reserve plans.

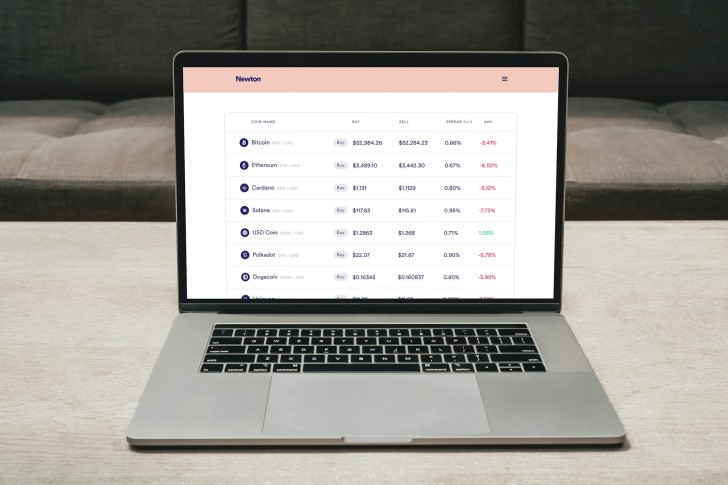

The cryptocurrency world is abuzz as the White House prepares to host its inaugural Crypto Summit on Saturday, March 7. This landmark event is expected to explore possibilities beyond the usual Bitcoin (BTC) and Ethereum (ETH) discussions, with Cardano (ADA), XRP, and Solana (SOL) potentially being considered for the U.S. Strategic Reserve. The summit will reportedly feature founders and key figures from these blockchain projects, though Bitcoin's anonymous creator, Satoshi Nakamoto, will understandably be absent.

Solana (SOL) Co-Founder's Perspective on Government Reserves

Anatoly Yakovenko, co-founder of Solana (SOL), has articulated three distinct scenarios regarding the proposed U.S. Strategic Reserve. His insights provide a nuanced view of the potential implications for cryptocurrency decentralization and governance.

Yakovenko's first scenario advocates for no reserve at all. He argues that putting government officials in charge of decentralized systems is fundamentally contradictory and would likely lead to failure. This perspective aligns with cryptocurrency's core ethos of minimizing centralized control and authority.

State-Level Solana (SOL) Reserves as an Alternative

The second scenario proposed by Yakovenko suggests that individual states could establish their cryptocurrency reserves. This approach would serve as a hedge against potential missteps by the Federal Reserve. By distributing reserve authority across multiple state governments, this model might preserve some aspects of decentralization while still providing governmental backing.

Criteria-Based Inclusion for Solana (SOL) and Other Cryptocurrencies

In his third scenario, Yakovenko concedes that if a reserve must exist, it should be founded on measurable and rational criteria. He maintains that even if these criteria currently favor only Bitcoin, that's acceptable. The Solana co-founder expressed confidence that if specific targets are established, the Solana ecosystem would adapt to meet them.

Controversy Surrounding Solana (SOL) Inclusion

Addressing rumors about Solana's involvement, Yakovenko firmly denied that he or anyone from the project had actively pitched SOL for inclusion in the reserve. He stated that he was never approached about the matter and never advocated for Solana's inclusion.

Furthermore, Yakovenko questioned the concept of a "Solana representative," comparing it to the notion of a "Bitcoin representative." His comments suggest that he views Solana as a decentralized network rather than an entity with designated spokespeople.

The proposal to broaden the reserve beyond Bitcoin and Ethereum has generated significant controversy within the cryptocurrency community. Many prominent voices in the space have expressed skepticism rather than enthusiasm. Some critics suggest that project founders might be seeking to boost their holdings through government backing, while others worry about the implications of state involvement for cryptocurrency's decentralized nature.

As the summit approaches, the debate surrounding the U.S. Strategic Crypto Reserve continues to intensify. The outcome of these discussions could significantly impact the future relationship between government institutions and cryptocurrency projects, potentially reshaping the landscape of digital assets in the United States.

Usman Salis

Usman Salis

Usman Salis

Usman Salis