Shiba Inu's marketing strategist, LUCIE, outlines the potential benefits and drawbacks of a SHIB ETF, highlighting its impact on accessibility, security, and DeFi principles.

The Pros of a SHIB ETF

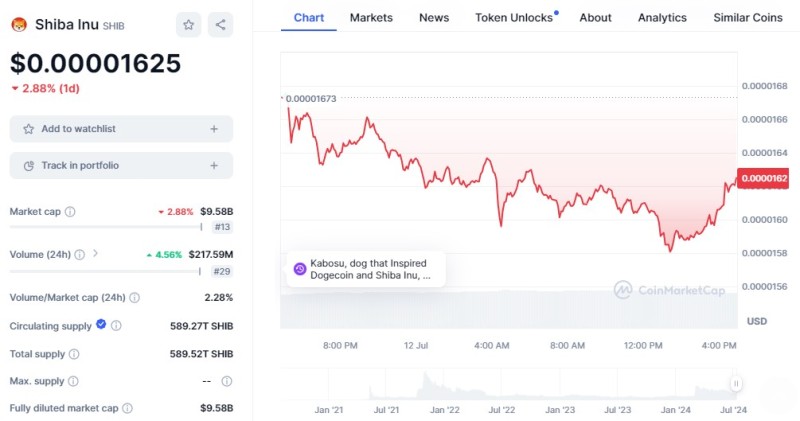

2024 has been a remarkable year for the cryptocurrency industry, with significant milestones such as the US Securities and Exchange Commission (SEC) approving spot Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs). These approvals have been met with considerable enthusiasm from industry participants, who speculate that other financial products with different underlying assets may soon follow.

Recently, Shibarium’s Marketing Strategist, LUCIE, discussed the potential of a SHIB ETF in a detailed X post. One of the key advantages highlighted was "accessibility."

"A SHIB ETF would make it easier for traditional investors to gain exposure to Shiba Inu without needing to navigate cryptocurrency exchanges," the post reads.

LUCIE emphasized that exchange-traded funds are regulated financial products, providing added security and potentially attracting institutional investors. Other advantages listed include diversification and increased demand for the meme coin. Additionally, spot crypto ETFs offer more benefits, as investors purchasing such products do not have to worry about storing and safekeeping their holdings or dealing with crypto exchanges.

Enhanced Security and Institutional Interest in SHIB

The introduction of a SHIB ETF could significantly enhance security for investors. Given that ETFs are regulated, they offer a level of protection that direct cryptocurrency investments often lack. This regulated environment could attract institutional investors who are wary of the risks associated with unregulated crypto markets.

LUCIE pointed out that the increased demand generated by a SHIB ETF could further stabilize the market. The ease of access and added security could lead to broader acceptance and integration of Shiba Inu within traditional financial systems.

Despite the potential benefits, LUCIE also outlined several reasons why launching a SHIB ETF might have negative implications for the decentralized finance (DeFi) sector. One major concern is that ETF investors would miss out on activities such as staking and governance, as they do not directly own the underlying cryptocurrencies.

Additionally, exchange-traded products come with management fees and are subject to regulatory oversight, which could introduce new challenges. There is also the risk of "market manipulation," where the centralization of SHIB control within ETFs could conflict with DeFi’s principles of transparency and decentralization.

Balancing the Pros and Cons

As the debate around a potential SHIB ETF continues, it is clear that both advantages and disadvantages must be carefully weighed. On one hand, the increased accessibility and security offered by an ETF could drive broader adoption and stability for Shiba Inu. On the other hand, the move could undermine the core principles of DeFi by centralizing control and introducing new regulatory challenges.

The discussion surrounding a SHIB ETF highlights a broader trend in the cryptocurrency industry: the integration of digital assets into traditional financial systems. As more cryptocurrencies gain acceptance and regulatory approval, the landscape of the financial market is likely to evolve significantly.

Ultimately, whether a SHIB ETF is introduced will depend on how the crypto community and regulators balance the benefits of accessibility and security with the need to maintain the decentralized nature of digital assets. As LUCIE’s insights reveal, this decision will have far-reaching implications for the future of Shiba Inu and the broader DeFi ecosystem.

Usman Salis

Usman Salis

Usman Salis

Usman Salis