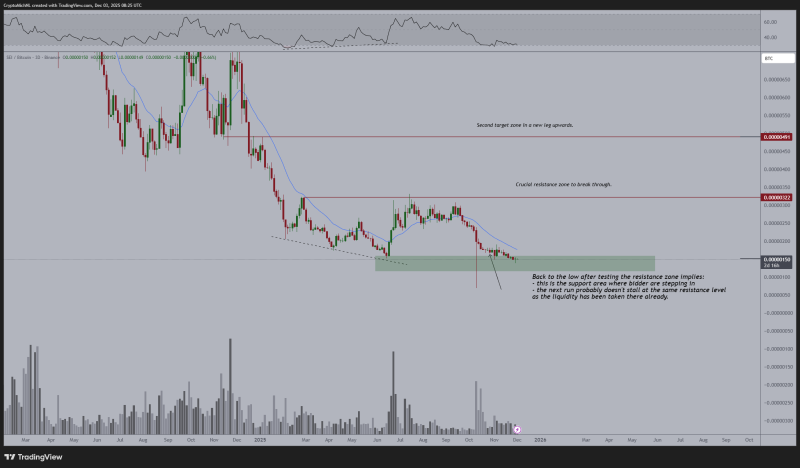

⬤ SEI has just staged one of the strongest rebounds among altcoins. After sliding for weeks, the price has returned to a major support zone that has drawn buyers in the past and now sits near its all time low versus Bitcoin. A recent failure at a key resistance has sent SEI back down to retest this accumulation level and the level is holding once again.

⬤ The standout feature is a bullish divergence that stretches across multiple timeframes. A wide divergence shows on the higher intervals plus a fresh one is shaping up on the shorter charts. Sentiment is starting to tilt upward, a shift that may feed stronger follow through.

SEI keeps a broad bullish divergence on the higher timeframes and a second divergence is beginning to form on the lower intervals.

⬤ The chart displays a green support block at the base of the long term downtrend. Volume has risen there and liquidity appears to pool in that zone. The first resistance to monitor lies near 0.00000322 BTC - a sustained push would target the next area around 0.00000491 BTC.

⬤ Volume behaviour also points to accumulation. Surges in activity coincide with the divergence signals. After SEI tested resistance but also returned to the lows, liquidity at prior reaction levels has already been cleaned out. That raises the odds that the next advance will break past former hurdles rather than stall.

⬤ This rebound is important because it may close the long phase of weakness and open a more constructive phase. Taken together - the divergences rising volume at support and repeated defence of the same price - the evidence points to active accumulation. How SEI behaves around this zone will decide whether a broader recovery begins or the token keeps struggling beneath overhead resistance.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah