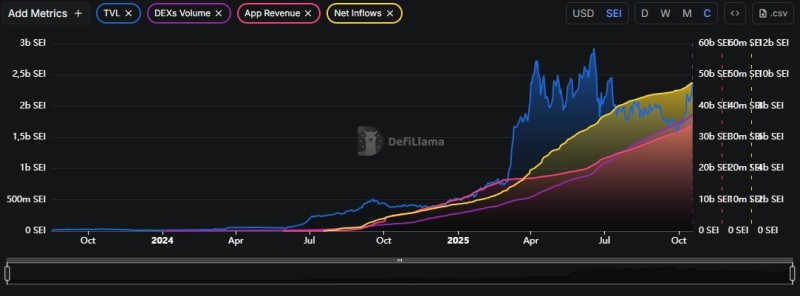

As the broader crypto market bleeds red, Sei emerges as a rare bright spot. Recent data from DeFiLlama reveals an ecosystem that's not just surviving—it's thriving. Through strategic moves in real-world assets, AI integration, and institutional-grade infrastructure, Sei is quietly positioning itself as a cornerstone of the next generation of decentralized finance.

Real-World Assets Drive Institutional Interest

A new analysis shared by WantCoinNews, Sei has become a go-to platform for tokenizing traditional assets. Apollo's $1.2B Diversified Credit Fund (ACRED) went live through Securitize and Wormhole, while BlackRock and Brevan Howard launched tokenized funds via KAIO. These aren't small experiments—they're billion-dollar validations of Sei's infrastructure. With 400ms finality and capacity for over 200K transactions per second, the network is built for the kind of scale institutions demand. Analysts expect the RWA market to hit $2.8 trillion by 2028, and Sei is positioning itself right at the center.

Stablecoin activity on Sei tells a compelling story. Circle's Gateway integration sparked $100M in USDC minting within just 10 days. PayPal's PYUSD arrived through LayerZero, and Agora's AUSD—backed by State Street and VanEck—is coming soon. Ondo's USDY now represents nearly 95% of Sei's RWA total value locked, showing where the smart money is flowing. Even Wyoming is testing Sei's infrastructure with its state-backed WYST pilot. The numbers speak for themselves: $5.5B in daily stablecoin volume and $243M issued in four months.

AI and Decentralized Science Find a Home

Sei is carving out space in cutting-edge sectors beyond traditional DeFi. Kindred Labs brought over 25 global IPs—from Teletubbies to Astro Boy—to life as AI companions on the network. Sapien Capital tapped Dr. Alex Cahana to lead a $65M Open Science Fund for blockchain-based research. At UNGA80, DeSci showcases connected more than 500 developers and 186 AI projects to Sei's ecosystem. This isn't hype—it's infrastructure being put to work.

Usman Salis

Usman Salis

Usman Salis

Usman Salis