After a significant correction that tested investor resolve, SEI (SEI/USDT) has stabilized around the $0.19 level, hinting at what may be the early stages of a recovery base. While recent volatility shook out weaker hands, conviction among long-term holders appears intact, with analysts viewing the current range as a strategic buying opportunity.

Current Market Position

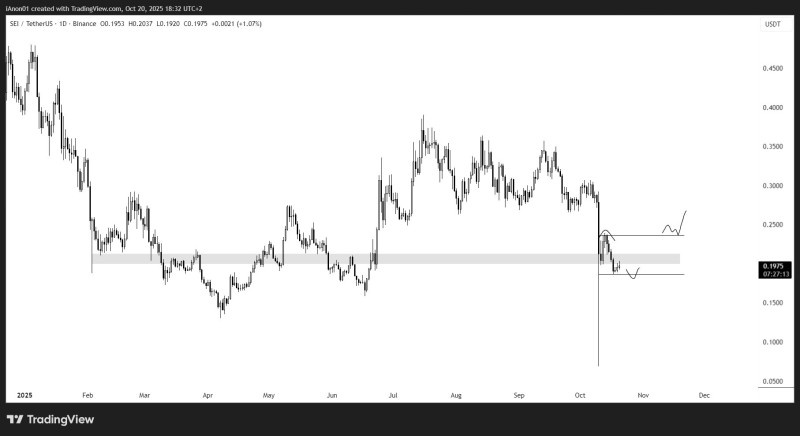

SEI is trading within a tight consolidation channel following its drop from above $0.25. The price found support near $0.19 after the breakdown, and has held steady there as buyers stepped in to defend this level. Crypto analyst WantCoinNews recently highlighted that this trading range was expected and represents a solid dollar-cost averaging opportunity for those building positions.

The daily chart shows SEI moving within a defined range after its decline. The gray-shaded zone marks a historically significant area that previously acted as support in early Q2 and has now been retested successfully. This type of behavior often signals accumulation before a potential move higher. Support sits around $0.18–$0.19, forming the lower boundary of the consolidation range, while resistance hovers near $0.25, representing the upper target for any near-term recovery. The chart suggests two possible scenarios: either a brief retest of support before climbing, or a gradual move toward the $0.25 resistance level.

Technical Picture

The sharp decline from $0.25 initially looked aggressive, but current price action suggests a possible bottoming pattern is forming. Long lower wicks around $0.19 show strong buying interest, while the absence of new lows indicates selling pressure is fading. This pattern of sharp decline followed by sideways movement often precedes trend exhaustion. If buyers continue absorbing supply at these levels, the market could shift into a reaccumulation phase, potentially setting up a move back toward $0.25 or beyond.

SEI's stabilization comes during a quieter phase across altcoins as the market digests recent weakness following Bitcoin's consolidation. Despite broader uncertainty, SEI maintains long-term appeal due to its focus on high-performance blockchain infrastructure, low-latency transactions, and a growing developer ecosystem. These fundamentals have kept holder confidence relatively strong, with short-term dips viewed as accumulation opportunities rather than signs of fundamental weakness.

Usman Salis

Usman Salis

Usman Salis

Usman Salis