Ripple's Chief Technology Officer, David Schwartz, issues crucial warnings regarding the newly launched XLS-30 AMM on XRP Ledger, advising caution to traders.

Ripple's AMM Launch on XRP Ledger

Ripple's Chief Technology Officer, David Schwartz, took to Twitter to announce the launch of the XLS-30 AMM (Automated Market Maker) on the XRP Ledger mainnet, marking a significant milestone for the platform's trading ecosystem.

The Role of XLS-30 AMM in XRPL DEX

The XLS-30 AMM integration into the XRP Ledger's Decentralized Exchange (DEX) promises a transformative shift in liquidity and trading dynamics, offering opportunities for users to earn returns by providing liquidity to the AMM. Moreover, it aims to mitigate slippage issues encountered while trading with a wide array of tokens.

Advice from Ripple's CTO

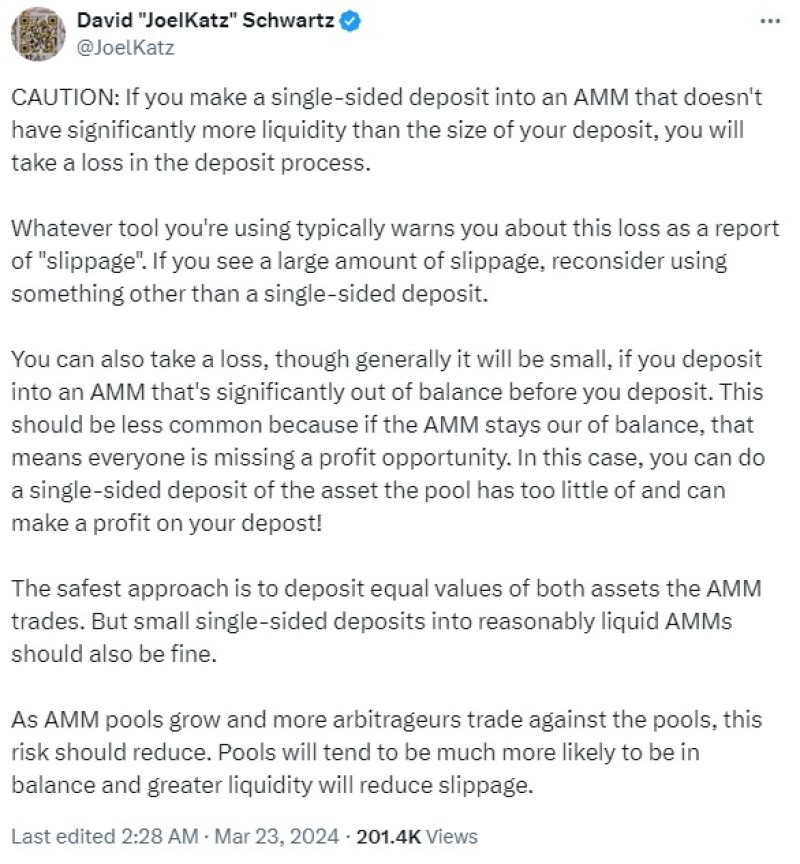

Schwartz's cautionary remarks underscore the potential risks associated with utilizing the AMM on the DEX. He emphasizes the importance of careful consideration before engaging in trading activities, particularly highlighting the perils of single-sided deposits into AMMs with lower liquidity.

Schwartz outlines several risk mitigation strategies for traders, suggesting that they opt for equal-value deposits of both assets traded by the AMM to minimize potential losses. Additionally, he advises traders to assess the liquidity of AMMs before executing single-sided deposits, advocating for prudent decision-making in navigating the evolving landscape of decentralized finance.

Addressing AMM Imbalances and Loss Scenarios

The Ripple CTO acknowledges the possibility of losses in scenarios where AMMs are out of balance or exhibit significant slippage. However, he reassures traders that such occurrences should be infrequent and expects the risk to diminish as AMM pools expand and arbitrageurs participate in trading against them.

Conclusion

As Ripple's AMM becomes an integral component of the XRP Ledger ecosystem, traders are urged to exercise caution and employ prudent strategies to mitigate risks. With Schwartz's guidance, stakeholders can navigate the evolving landscape of decentralized finance with greater confidence and resilience.

Usman Salis

Usman Salis

Usman Salis

Usman Salis