PEPE token shot up 6% in 24 hours as traders stepped in to defend crucial price levels, while the broader memecoin market gained 7%. Trading volume hit 4.6 trillion tokens as exchange balances dropped 2.6% over the past month.

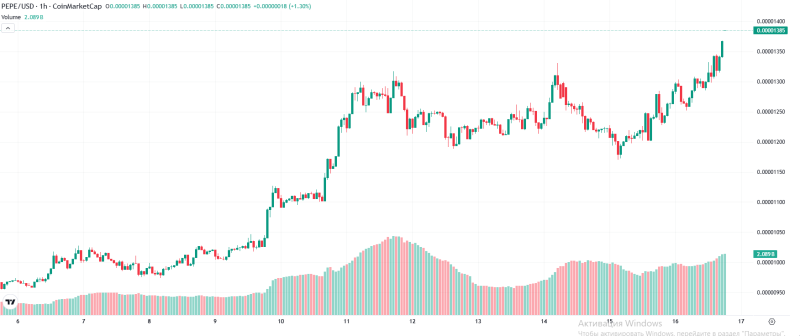

PEPE had quite the day yesterday, climbing over 6% to reach $0.00001285. But it wasn't a smooth ride - the frog-themed token swung wildly between $0.000011981 and $0.000013081, creating a nearly 9% intraday range that kept everyone on edge.

What's interesting isn't just that PEPE went up, but how it happened. Every time the price dipped toward $0.000012600, buyers jumped in to push it back up. It's like traders drew a line in the sand and said "not today."

PEPE Price Finds Strong Support Despite Wild Swings

The technical picture tells a pretty clear story. PEPE hit resistance around $0.00001286, where algorithmic trading systems kicked in twice and reversed the price on heavy volume, according to CoinDesk Research data. Meanwhile, that $0.000012600 level acted like a magnet for buyers.

Even as the session wound down, bids around $0.000012820 held firm. That's a good sign - it suggests people aren't just dumping their tokens at the first sign of trouble. Instead, they're sticking around and actually defending the price.

PEPE Trading Volume Goes Through the Roof

Here's where things get really wild: trading volume hit 4.6 trillion PEPE tokens. To put that in perspective, that's more dollar volume than many mid-sized stocks see in a day. When a memecoin is trading at those levels, you know something's up.

This wasn't just a quick pump either. The volume stayed high throughout the session, which usually means there's real interest behind the moves rather than just speculation.

PEPE Outshines Broader Crypto Market

PEPE wasn't alone in its gains - the whole memecoin sector had a good day. The CoinDesk Memecoin Index (CDMEME) surged 7.12% compared to just 3.3% for the CoinDesk 20 Index of major cryptocurrencies. But PEPE's 6% gain within that context shows it was one of the stronger performers.

What's even more telling is the exchange balance data from Nansen. PEPE balances on exchanges have dropped 2.6% over the past 30 days. When people move tokens off exchanges, it usually means they're planning to hold rather than sell, which reduces selling pressure and can help push prices higher.

The combination of strong technical support, massive volume, and people actually taking tokens off exchanges creates a pretty bullish picture for PEPE right now.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah