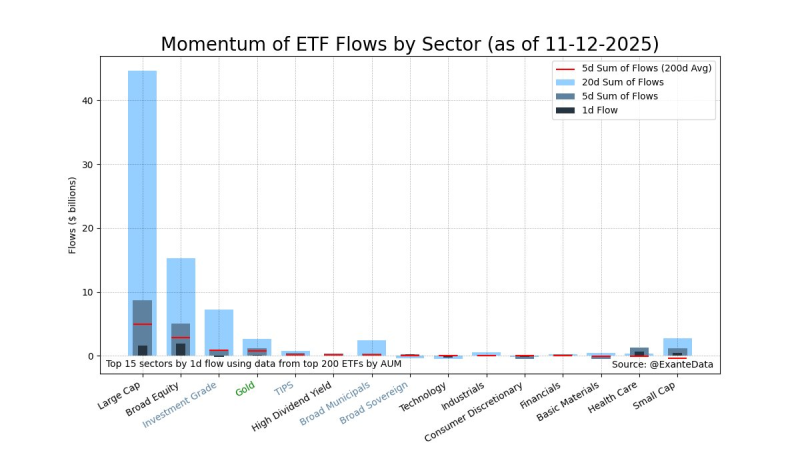

⬤ U.S. equity markets are seeing a clear shift as ETF flows increasingly favor Large Cap and Broad Equity sectors. Investors are moving capital into the most liquid, stable parts of the market—a classic sign of defensive positioning. The data shows inflows into these sectors running well above historical norms, while cyclical segments are losing momentum.

⬤ This rotation comes as speculation grows around potential tax changes that could reshape the investment landscape. Though nothing's set in stone, any hikes to capital-gains taxes or new transaction fees could hit high-turnover strategies and smaller players especially hard. There are real worries about what this might mean for market liquidity and whether some specialized firms could face serious pressure or even go under.

⬤ The numbers tell a straightforward story: Large Cap and Broad Equity are pulling in the biggest inflows relative to their averages, while Consumer Discretionary and Basic Materials are bleeding capital. This split suggests investors are getting cautious about economically sensitive sectors, possibly reacting to inflation concerns, weaker consumer spending, or shifting Fed policy expectations.

⬤ If this pattern holds, we could see U.S. equities move further into defensive mode, with money concentrating in mega-cap names and broad market funds while cyclical sectors stay under pressure. The latest ETF flow data makes it clear that tracking sector momentum matters more than ever as investors brace for continued volatility and policy uncertainty.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova